This time of the year I always enjoy planning out my next year.

This time of the year I always enjoy planning out my next year.

That means making plans for what I want to accomplish at my 9-5, as well as where I want to focus my time and energy when it comes to my side projects.

One of the fun things to think about is travel. And this year my wife and I have a big goal: to take a trip to Europe.

Not only do we want to go to Europe, we want to pay nothing for the flights.

How do we plan on doing it? Read on to find out.

Travel Hacking Explained

If you aren’t familiar with travel hacking, it’s the process of using credit card rewards – primarily sign-up rewards – for free or reduced travel.

I’ve been travel hacking for a few years now, and a while back I shared every card I’ve ever churned. To “churn” a card is to sign up for it, use the sign-up bonus, and then close the card. Granted I don’t close every card, but whether or not to close a card is worthy of another post itself.

Credit card companies are desperate for new customers so they offer rewards. Some are focused on cash back rewards (here’s my top three). Others are focused on travel.

Besides a sign-up bonus many rewards cards will waive their annual fee for the first year, if they have one at all. This presents an opportunity to use the reward and close the card before a year has lapsed.

Not every credit card waives the annual fee. And the card I plan on using to fly to Europe for free comes with a hefty price tag. Allow me to explain.

Travel Hacking a Flight to Europe for Free

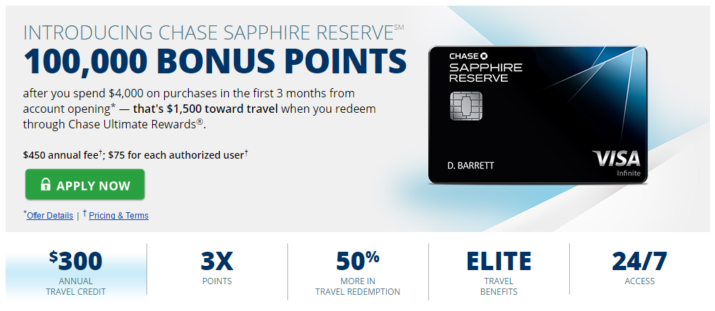

The card I plan on using is called Chase Sapphire Reserve. This is a newer card offering from Chase that gives you 100,000 Chase Ultimate Rewards points when you sign up and spend $4,000 within the first three months.

There is one catch: the annual fee of $450 is not waived.

This may seem like a lot of money – and it is – but let’s not panic. There is an additional perk with this card where you get a $300 annual statement credit that will go towards any travel-related expenses. That means that if you already are planning on spending at least $300 in travel the annual fee (in theory) drops to $150.

But still, why would I want to pay that much money? The answer is simple – the Chase Ultimate Rewards points are valuable. They transfer 1:1 to a number of partner programs, including:

- British Airways Executive Club

- Korean Air SKYPASS

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards®

- United MileagePlus®

- Virgin Atlantic Flying Club

- Hyatt Gold Passport®

- IHG® Rewards Club

- Marriott Rewards®

- The Ritz-Carlton Rewards®

The one that I find most useful is the United MileagePlus program. I have the United Airlines credit card and it’s typically what we use to travel, mainly due to the fact that we already signed up for a few cards where we received miles.

So the plan can be summarized like this:

- Sign up for the Chase Sapphire Reserve credit card

- Put at least $4,000 on the credit card within the first three months

- Transfer the points to my United MileagePlus account

- Book the flights using rewards points

- Put at least $300 worth of travel expenses on the Chase Sapphire Reserve card to take full advantage of the $300 credit

- Close the Chase Sapphire Reserve card before it renews

There are, of course, other perks with Chase Sapphire Reserve that might make it worth renewing. For example you receive access to 900+ airport lounges worldwide with complimentary Priority Pass Select membership. You’d have to weigh whether the $150 price tag (after getting $300 of your $450 back from the annual travel credit) makes it worth keeping.

Using the Points

Neither of us have been to Europe so it’s exciting to plan for it. Those who have been to Europe – or even those who live there – know that there are many countries and cities that you can visit.

For us we are looking at an approximately two-week trip. We’ll spend one week in one city and one week in another city. I’m fairly set on Paris as one of the cities as there is so much to experience there. Plus I’ve been learning French on the Duolingo app.

The big question is this: How many United MileagePlus points will we need to fly to Europe for free?

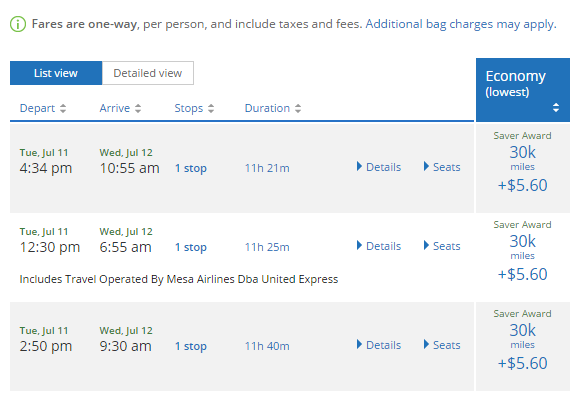

Looking at flights next Summer I quickly found that we’d need approximately 30k miles for each leg of the trip. For two people that comes to 120k miles.

You are probably thinking “But that’s more than 100k.”

While that’s true, there are other ways to get United MileagePlus miles besides the Chase Sapphire Reserve card. They include the United MileagePlus Explorer card (30,000 points) and the Chase Sapphire Preferred card (50,000 points).

I already have the United MileagePlus Explorer card and have the additional 20k points saved so I won’t need to sign up for any additional cards, but if you are trying to go this route I would recommend getting the United MileagePlus Explorer card. You only have to spend $1,000 within the first three months of having the card to get 30,000 United MileagePlus miles, and you get two free checked bags. Well worth it.

______________________________________

That sums up how we plan on flying to Europe for free. Yes, you may need to put quotes around “free” as we are essentially eating $150 in costs to sign up for the Reserve card, but with the opportunity to save $1,000 to $2,000 in total on flights it’s well worth the expense.

Interested in getting started with travel hacking? Read the 7 keys to successful travel hacking to get started on the right foot!

More Ideas for Affording Travel

Credit cards may get you a free flight and, in some cases, some of your other travel expenses, but what if you still need more money to make your international travel dreams possible?

Thankfully there are many ways to increase your income through side hustles. And what could be a better use of side hustle income than travel???

-

Start a Blog – this is my favorite side hustle, though I will admit I am a bit biased as I’ve been blogging for years now.

There are countless benefits when it comes to blogging, from leveraging it to sell your own products and services, to using it to become an authority in your area of interest or expertise, to making money through affiliate links (there’s plenty to go around, trust me).

Who knows? Blogging could end up paying for multiple vacations a year, and then some. Or you could take my approach and pay off your student loans and other debt through blogging income, freeing up cash flow for fun stuff like travel!

- Could you use a little extra money but don’t have a lot of time? Make some easy side cash by using apps like Swagbucks, Ibotta, or one of these 7 websites & apps.

- Not sure you want to start a blog and want to make more money than what Swagbucks and other “easy” extra income ideas can offer you?

No worries! I’ve got you covered. I wrote a (monster) post that lists 50+ legitimate ways to make side hustle income online and at home. This post provides ton of ideas of side hustles you can pursue to make more money and pursue the trip of your dreams.

interesting I’m sure you’ll enjoy your european holiday:D

Yes I’ve never been so it should be fun! Really looking forward to it.

Sound like a great trip, DC! My husband actually ran across this card a couple of weeks ago and thought we should give it a go. You make a great point about the annual fee – you really only have to pay the $150.

Yes the card is a great opportunity! Whenever I have a chance at getting more United miles I’m all for it!

It’s good to hear that the 5/24 Chase rule didn’t get you. There’s lots to do in Paris & the surrounding countryside. We did a 24-hour layover in Paris with my college roommates for Spring Break so we only got to see the highlights. But, it’s a great romantic getaway opportunity with your wife.

Rome is probably my favorite place if I could go back again. The Mediterranean climate (which might be a little warm in the summer) and the history of Rome and the Vatican.

I spent a college semester in Sevilla, Spain which was cool too but the bigger cities offer more bang for the buck.

The 5/24 Chase Rule got me in the past, but I’ve been intentional about making sure I qualify for the Reserve. Paris seems like a city that deserves more than 24 hours, but 24 hours is better than nothing!

Personally, I think it’s wrong on a money saving blog to encourage people to open credit cards for rewards. You’re playing with fire, and many will get burned. This seems like you’re leveraging debt, which is never fiscally responsible. Save up bash for your vacations.., there’s no perfect scheme out there!

I clearly disagree : ) I’ve saved thousands of dollars through credit card churning and haven’t had any issues with debt or spending money I wouldn’t otherwise spend. I recognize this isn’t the case for some, and for those I would encourage them to NOT sign up, or to sign up for a service like Debitize (https://www.youngadultmoney.com/2016/06/07/scared-of-credit-cards-try-this-free-service-that-adds-spending-safeguards/) that essentially turns your credit card into a debit card.

I respect anyone’s decision to NOT use credit cards for rewards, but it’s extremely beneficial (and saves thousands) for those who can use them appropriately.

Looking forward to hearing about your adventures DC :)!

Have you considered the countries you’d like to visit?

Now all you’ll have to do is travel hack your way to Aus haha

Thanks man! France for sure as I’ve been learning French the past ~6 months. The other leading candidate is Italy right now but considering Greece as well. It’s really tough since neither Victoria or I have been to Europe before so there are so many good options.

Hey we actually have enough miles for Australia! Unfortunately the discounted flights are typically during your Winter time ; ) Victoria wants to go snorkeling and scuba diving so we have to go when it’s warmer!

I’ve never been to Greece but I’ve been to Italy multiple times. Venice is amazing (just like what you’d imagine) and if you like gelato, pizza & pasta then it’s heaven!

Great strategy DC. I applied for the Reserve but was swiftly denied for being way over the Chase 5/24 rule. I was considering waiting but there are so many good card offers out there I’m not sure if it would be worth it to wait 2 years. I felt a little better that day as I was approved for the Bank of America travel rewards card and an AAdvantage card.

Travel hacking is awesome! If you pay the balance in full of course.

Yeah it’s pretty difficult for travel hackers to get under that 5/24 rule, but if you are able to it’s a REALLY great card to get for all the United miles you can rack up.

Travel hacking is something that I plan on doing once I get my debt a little lower. I’m willing to open a couple of cards if it can help me keep my travel costs down.

Great plan, Jason! Would definitely recommend checking out the Reserve as one of your first cards. A hefty annual fee but the $300 travel credit and big sign-up bonus makes it worth it imo.

You’re going to LOVE Paris – I lived there for a year during college and it was one of the best years of my life!

Oh that’s great to hear Ashli! I’ve been trying to learn French the past year so it will be fun to actually use what I’ve learned : )