It’s that time of year again – time to shop for gifts.

It’s that time of year again – time to shop for gifts.

I don’t know about you, but I love giving – and receiving – practical gifts.

Give me something that I can make productive and practical use of and I’m a happy camper. Bonus points if it helps me improve myself.

While gift cards are great there is something nice about giving something a little more meaningful. My sister’s birthday was a couple months ago and I gave her two gifts.

The first gift was a “gag” gift of sorts as it was her 30th birthday and I thought something funny from our past would be appreciated. So I gave her a picture of me in a picture frame and a vanilla candle, the same gift I would give her growing up (I wasn’t good at picking out gifts – clearly).

The second gift was a new release from one of her favorite authors. She seemed to really appreciate it and it’s definitely something that she is going to find useful.

Books are great gifts for many reasons, but personal finance books provide that extra level of self-improvement and practical use. With so much out there to know about finances and with finances touching so many areas of our lives, who couldn’t use more info on how to improve their finances?

So today I have a list of NEW personal finance books that you can give as gifts. All these books were published in 2016!

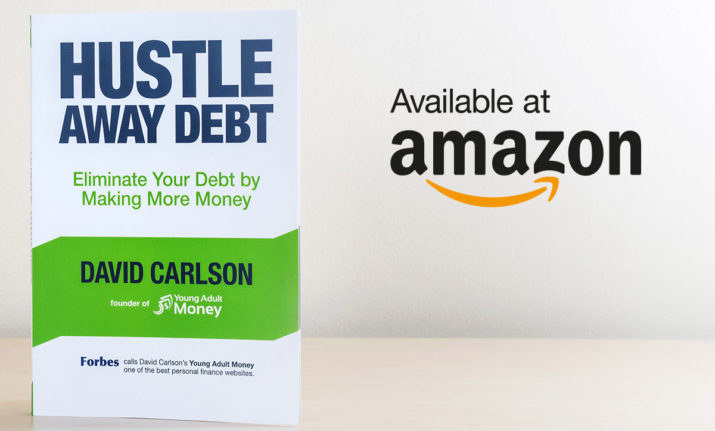

Hustle Away Debt

How could I not start with my book? Hustle Away Debt is my first book and it’s focused on helping people pay off their debt faster through side hustles.

The inspiration for this book was my wife and my own story, which starts with graduating college with $100k in student loan debt. For the past 5 years I’ve worked side hustles in my spare time to increase my income.

If you have debt or a desire to increase your income this book was written for you. It helps you choose the right side hustle for you, ideas for side hustles, and how to make the best use of your side hustle.

Title: Hustle Away Debt

Author: David Carlson

Ideal For: People who want to pay off their debt faster, people working 9-5 jobs that wish they were running a business instead, and anyone looking to increase their income.

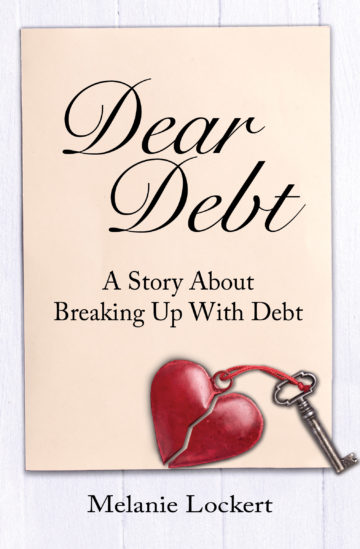

Dear Debt: A Story About Breaking Up With Debt

From Amazon: In her debut book Dear Debt, personal finance expert Melanie Lockert combines her endearing and humorous personal narrative with practical tools to help readers overcome the crippling effects of debt

Drawing from her personal experience of paying off eighty thousand dollars of student loan debt, Melanie provides a wealth of money-saving tips to help her community of debt fighters navigate the repayment process, increase current income, and ultimately become debt-free.

By breaking down complex financial concepts into clear, manageable tools and step-by-step processes, Melanie has provided a venerable guide to overcoming debt fatigue and obtaining financial freedom.

Title: Dear Debt

Author: Melanie Lockert

Ideal For: People who are in debt and want to become debt-free

You Only Live Once: The Roadmap to Financial Wellness and a Purposeful Life

From Amazon: You Only Live Once is the guide to achieving your best life through smart money moves. Before you even begin making a budget, you need to think about why.

Where do you see yourself financially in ten years? Five years? This time next year? What does money do for you? Once you know your destination, you can begin charting your course.

Step-by-step guidance walks you through the budgeting process, and shows you how to plan your financial path to point toward your goals. You’ll learn how to prioritize spending, how to save efficiently, and how to take advantage of simple tools you didn’t know you had. Next comes the most important part: taking control. You need to really look at how you perceive and use money day-to-day. Chances are, changing a few habits could give you some breathing room and help you reach your goals sooner.

Title: You Only Live Once

Author: Jason Vitug

Ideal Reader: People who aren’t content with their current life and want something “more” but are unsure of what changes to make

The Recovering Spender: How to Live a Happy, Fulfilled, Debt-Free Life

From Amazon: After learning how to curb her spending habits, Lauren Greutman shares her hard-earned knowledge on how to get out of debt and live without the financial pressures that many people face today.

Millions of Americans today are near financial disaster-spending more money than they are bringing in, and losing control of their money. Lauren Greutman knows how that feels. For years, she struggled with too many bills to pay and not enough money to pay them. When Lauren found herself drowning in debt, she finally faced her extreme spending habits and took action.

In The Recovering Spender, Lauren shares her story and offers advice that is based on the many strategies she developed to change her own life and bring her family budget back to black.

Title: The Recovering Spender

Author: Lauren Greutman

Ideal Reader: People who have a “spending problem” and would benefit from cutting expenses and budgeting

Corporate Survival Guide for Your Twenties: A Guide to Help You Navigate the Business World

From Amazon: Welcome to the corporate world, friend! A world where things aren’t fair, some people are mean, and if you want to succeed, your boss has to like you.

In her new book: Corporate Survival Guide for Your Twenties: A Guide to Help You Navigate the Business World, Kayla Buell, founder of the award-winning blog Lost GenY Girl, helps you face the corporate world post-college. Navigating a corporate working world filled with pitfalls and traps is not easy there’s no app for that.

Should you speak up in meetings? Should you stay quiet? Should you eat at your desk? What should you wear? And what do you do when someone blasts you via e-mail? In Corporate Survival Guide for Your Twenties, Buell helps the early career professionals get their kick-ass career running!

Title: Corporate Survival Guide for Your Twenties

Author: Kayla Cruz

Ideal Reader: Millennials who are about to enter the workforce or who have recently graduated and entered the workforce

Love Your Life, Not Theirs: 7 Money Habits for Living the Life You Want

From Amazon: In Love Your Life, Not Theirs, Rachel shows you how to buy and do the things that are important to you–the right way. That starts by choosing to quit the comparisons, reframing the way you think about money, and developing new habits like avoiding debt, living on a plan, watching your spending, saving for the future, having healthy conversations about money, and giving.

These habits work, and Rachel is living proof. Now, she wants to empower you to live the life you’ve always dreamed of without creating the debt, stress, and worry that are all too often part of the deal. Social media isn’t real life, and trying to keep up with the Joneses will never get you anywhere. It’s time to live – and love – your life, not theirs.

Title: Love Your Life, Not Theirs

Author: Rachel Cruze

Ideal Reader: People who compare themselves to others and want (need) to change so that they are happier and healthier from both a financial and emotional standpoint

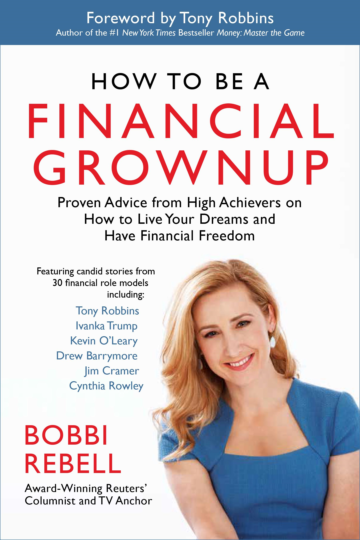

How to Be a Financial Grownup: Proven Advice from High Achievers on How to Live Your Dreams and Have Financial Freedom

From Amazon: Bobbi Rebell, award-winning TV anchor and personal finance columnist at Thomson Reuters, taps into her exclusive network of business leaders to share with you stories of the financial lessons they learned early in their lives that helped them become successful. She then uses these stories as jumping off points to offer specific, actionable advice on how you can become a financial grownup just like them.

Financial role models such as Author Tony Robbins, Entrepreneur Ivanka Trump, Shark Tank’s Kevin O’Leary, Mad Money’s Jim Cramer, Designer Cynthia Rowley, Macy’s CEO Terry Lundgren, Zillow’s CEO Spencer Rascoff, PwC’s CEO Bob Moritz, and twenty others share their stories with you.

Title: How to Be a Financial Grownup

Author: Bobbi Rebell

Ideal Reader: People who want new ideas that help them better manage their finances and are interested in hearing tips from some successful individuals

The Art of Money: A Life-Changing Guide to Financial Happiness

From Amazon: The Art of Money is the book your money-savvy best friend, therapist, and accountant would write if they could. Bari Tessler’s integrative approach creates the real possibility of “money healing,” using our relationship with money as a gateway to self-awareness and a training ground for compassion, confidence, and self-worth.

Tessler’s gentle techniques weave together emotional depth, big-picture visioning, and refreshingly accessible, nitty-gritty money practices. Guiding readers through a step-by-step journey, The Art of Money will help anyone transform their relationship with money and, in so doing, transform their life. As the author writes, “When we dare to speak the truth about money, amazing healing begins.”

Title: The Art of Money

Author: Bari Tessler

Ideal Reader: People who want to build confidence and change their life, starting with their finances

Retire Inspired: It’s Not an Age, It’s a Financial Number

From Amazon: When you hear the word retirement, you probably don’t imagine yourself scrambling to pay your bills in your golden years. But for too many Americans, that’s the fate that awaits unless they take steps now to plan for the future.

Whether you’re twenty-five and starting your first job or fifty-five and watching the career clock start to wind down, today is the day to get serious about your retirement.

In Retire Inspired, Chris Hogan teaches that retirement isn’t an age; it’s a financial number—an amount you need to live the life in retirement that you’ve always dreamed of. With clear investing concepts and strategies, Chris will educate and empower you to make your own investing decisions, set reasonable expectations for your spouse and family, and build a dream team of experts to get you there.

Title: Retire Inspired

Author: Chris Hogan

Ideal Reader: People who are interested in early retirement and financial independence

The Index Card: Why Personal Finance Doesn’t Have to Be Complicated

From Amazon: TV analysts and money managers would have you believe your finances are enormously complicated, and if you don’t follow their guidance, you’ll end up in the poorhouse.

They’re wrong.

When University of Chicago professor Harold Pollack interviewed Helaine Olen, an award-winning financial journalist and the author of the bestselling Pound Foolish, he made an offhand suggestion: everything you need to know about managing your money could fit on an index card. To prove his point, he grabbed a 4″ x 6″ card, scribbled down a list of rules, and posted a picture of the card online. The post went viral.

Now, Pollack teams up with Olen to explain why the ten simple rules of the index card outperform more complicated financial strategies. Inside is an easy-to-follow action plan that works in good times and bad, giving you the tools, knowledge, and confidence to seize control of your financial life.

Title: The Index Card

Author: Helaine Olen and Harold Pollack

Ideal Reader: People who are overwhelmed by personal finance

One last suggestion to consider purchasing my book Hustle Away Debt as a gift! It’s perfect for anyone who has debt or wants to increase their income.

Here’s some of our other book & gift lists:

What books will you be giving as gifts this Christmas?

It’s not bad if I ask friends and family to get ME these, is it? :)

Absolutely not! If anything I would encourage that!

Great reads and inspiration for those New Years resolutions!

For sure! Lots of practical takeaways in these books!

This is a great list! I haven’t read many of them – they are going on my wish list.

Oh you will definitely have to check them out then! Lots of good options here. So many good books came out in 2016.

Good list DC, there were a few I’ve not heard of before so I’ll have to check them out. I’m big on practical gifts as well, especially if it’s something I can learn from and use in my life.

I’m the same as you John. If it’s practical or can improve my life, I’m on board! Basically the only gifts I ask for these days.

Another new great one to consider is “99-Minute Millionaire” from Scott Alan Turner. Quick and interesting read on beginner investing. Thanks for this list!

I haven’t heard of that one so I will definitely have to check it out. Thanks for sharing!

Nice list here DC! Cheeky one adding your book although yep I feel it deserves more than a mention ;) (I’ll be honest and say I haven’t picked up a copy yet although I will haha)

I’ve read Tony Robbin’s one and it’s fantastic, a few suggestions here I can add to my list though!

Thanks

What the heck Jef? I thought you were the #1 Young Adult Money fan?!? And you haven’t read Hustle Away Debt?!? Very disappointed to hear. But I have faith you will follow through : )

Yes consider checking out some of the other ones! Lots of good stuff on this list! Granted I’m a bit biased because I put it together ; )

Haha close to #1 fan man, I feel like Victoria probably is ;).

You know what? I’ve actually popped it in my reminders for Christmas break so it’ll be sooner rather than later, faith restored? :)

Haha you are right about Victoria! Keen insight there!

But yes faith is restored!

interesting list thanks for sharing!

Of course! Hope you are able to use some of these as gifts!

I have heard of a few of these, namely yours, Rachel Cruze, & the Index Card Challenge.

One gift suggestion for your sister if she doesn’t have one already, an autographed copy of “Hustle Away Debt” ;-)

Oh she definitely has a copy! We had the book release party at her apartment complex!

Great list here! Your book is perfect for the millions trying to pay off student debt I hope you sell many copies over the holidays. Thanks for the gift ideas.