This is part 3 in our summer reading series! Find books that will help you pay off debt here, and books that will help you be more productive here.

This is part 3 in our summer reading series! Find books that will help you pay off debt here, and books that will help you be more productive here.

So you want to become a master at managing your money.

It’s a skill very much worth having, as money management can help you get ahead in many different areas of your life.

But…where do you start?

There’s budgeting, paying off debt, investing, financing, and not to mention the emotions that come along with making major financial decisions.

Deep breath! Don’t worry.

This roundup of books will help you manage your money like a boss so worrying about your financial situation becomes a thing of the past.

1) Why Didn’t They Teach Me This in School?: 99 Personal Money Management Principles to Live By

Why Didn’t They Teach Me This in School?: 99 Personal Money Management Principles to Live By, by Cary Siegel attempts to give those on the younger side a broad overview of money management basics that you should have learned in school.

Why Didn’t They Teach Me This in School?: 99 Personal Money Management Principles to Live By, by Cary Siegel attempts to give those on the younger side a broad overview of money management basics that you should have learned in school.

I love that he originally wrote this book for his kids. Siegel actually retired at age 45, and upon realizing that money management education is rarely covered in the real world, decided he needed to pass some important money lessons along to his kids.

While there are 99 principles covered, the book largely focuses on eight lessons that Siegel learned throughout his life. It’s a quick read with lots of personal examples – something I think all personal finance books need to make them a bit more interesting and relatable.

Recommended for…High school and college grads looking to kick start their financial life.

2) Soldier of Finance: Take Charge of Your Money and Invest in Your Future

Soldier of Finance: Take Charge of Your Money and Invest in Your Future was written by fellow personal finance blogger, CFP, and army veteran Jeff Rose. (And if you aren’t familiar with him you’re missing out – he’s pretty funny!)

Soldier of Finance: Take Charge of Your Money and Invest in Your Future was written by fellow personal finance blogger, CFP, and army veteran Jeff Rose. (And if you aren’t familiar with him you’re missing out – he’s pretty funny!)

You can read the many, many accolades from other finance bloggers on the Amazon page, but in short, Rose took inspiration from the military to author a “boot camp” style guide to the fundamentals of personal finance.

There are 14 modules that cover the must-knows of money management so you can arm yourself with the knowledge you need to become a soldier of finance. It’s an interesting read as Rose makes analogies from his time in the army to bring a different perspective to personal finance.

Recommended for…Anyone who needs a briefing on how to manage their money for the long-term.

3) How to Manage Your Money When You Don’t Have Any

Next on our list is How to Manage Your Money When You Don’t Have Any. I really like the title of this book. Erik Wecks wrote this for the everyday average person who’s tired of living paycheck-to-paycheck, but doesn’t know where to start with breaking that cycle.

Next on our list is How to Manage Your Money When You Don’t Have Any. I really like the title of this book. Erik Wecks wrote this for the everyday average person who’s tired of living paycheck-to-paycheck, but doesn’t know where to start with breaking that cycle.

It’s a great book to read if you just want a basic overview of how to focus on creating more wealth in your life. It was written for people who don’t have any prior knowledge of personal finance, so it’s easy to understand.

Wecks also focuses on changing your perspective when it comes to money. Many people who are (or feel) broke have a negative relationship with money, and that has to change in order to make progress.

Recommended for…Those who want to stop treading water with their money and need practical advice on how to become less dependent on their paycheck to survive.

4) 925 Ideas to Help You Save Money, Get Out of Debt and Retire a Millionaire

Devin D. Thorpe compiled 925 ideas on the basics of money management for those who need a primer on the actions they should be taking to get in better financial shape.

Devin D. Thorpe compiled 925 ideas on the basics of money management for those who need a primer on the actions they should be taking to get in better financial shape.

925 Ideas to Help You Save Money, Get Out of Debt and Retire a Millionaire is best for those who are in their early 20s or those who have been inflating their lifestyle to the point of going into debt. Much of what is covered in this book has been deemed “common sense,” but considering its popularity, it has worthwhile lessons for those who need it.

So if you aren’t a voracious reader of personal finance literature, you’ll likely find what you need in this book to start on a path to better money management.

Recommended for…Those who need to develop better financial habits, especially families, who haven’t started educating themselves on personal finance fundamentals.

5) The One Week Budget: Learn to Create Your Money Management System in 7 Days or Less!

The One Week Budget: Learn to Create Your Money Management System in 7 Days or Less! is yet another book by a fellow personal finance blogger makes the list! Tiffany “The Budgetnista” Aliche has a really fun way of explaining the budgeting basics everyone that’s new to money management needs to know.

The One Week Budget: Learn to Create Your Money Management System in 7 Days or Less! is yet another book by a fellow personal finance blogger makes the list! Tiffany “The Budgetnista” Aliche has a really fun way of explaining the budgeting basics everyone that’s new to money management needs to know.

She uses Bella the Budgetnista as an example throughout the book, which can help you follow along with all the exercises.

This is a step-by-step guide to getting your money in order and getting a system in place to automate your finances. If managing it all is a bore, Aliche’s action steps are the ones you’ll want to take.

Recommended for…Those who might already know the basics, but don’t know how to put all the information together to develop a system to actually manage their money.

6) The Millionaire Next Door: The Surprising Secrets of America’s Wealthy

The Millionaire Next Door: The Surprising Secrets of America’s Wealthy is a classic, so don’t think it’s near the bottom for a reason! Doctors Thomas J. Stanley and William D. Danko present their research and data from the millionaires they interviewed so you get a real glimpse into the life of the wealthy.

The Millionaire Next Door: The Surprising Secrets of America’s Wealthy is a classic, so don’t think it’s near the bottom for a reason! Doctors Thomas J. Stanley and William D. Danko present their research and data from the millionaires they interviewed so you get a real glimpse into the life of the wealthy.

What they found might surprise you. They compiled a list of 7 traits millionaires have in common, and none of these traits are what you normally see on TV. Nor do they involve what most people think of when they hear the word “millionaire.”

I’m including it on this list because it provides great lessons and amazing context for growing your wealth. The reality is most millionaires work their way to wealth. There aren’t any actual “secrets” because it’s attainable for most people if they just follow these common principles.

Recommended for…Those who don’t think it’s possible to achieve wealth and believe that millionaires are either the highly paid stars and athletes of society, or those who inherited riches. It’s time to change your perspective.

7) The Richest Man in Babylon

Let’s continue with the classics, shall we? A lot of people know about The Richest Man in Babylon. Authored by George S. Clason, it contains many personal finance lessons – from budgeting, to being thrifty, to investing – for the beginner and experienced alike.

Let’s continue with the classics, shall we? A lot of people know about The Richest Man in Babylon. Authored by George S. Clason, it contains many personal finance lessons – from budgeting, to being thrifty, to investing – for the beginner and experienced alike.

These lessons are told in story form (with parables), which quite a few people might prefer, and it’s a shorter read. It’s a bestselling classic for a reason! While it’s on the older side, personal finance basics don’t change. What’s true hundreds of years ago remains true today.

Recommended for…There isn’t anyone I wouldn’t really recommend this for. Lots of people say it makes for a great gift for graduates, but I think anyone can benefit from the lessons taught.

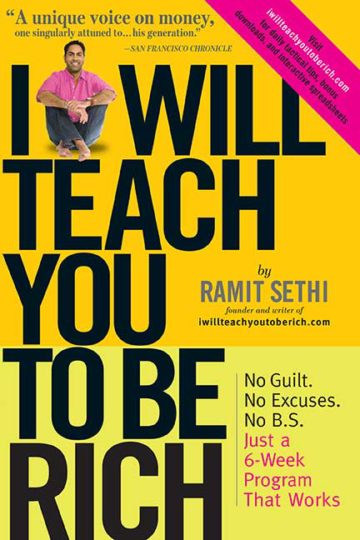

8) I Will Teach You To Be Rich

Ramit Sethi is a powerhouse in the personal finance, career/entrepreneurship arena (and he has a blog by the same name). His philosophy is the exact opposite of what you usually find in money management books.

Ramit Sethi is a powerhouse in the personal finance, career/entrepreneurship arena (and he has a blog by the same name). His philosophy is the exact opposite of what you usually find in money management books.

In I Will Teach You To Be Rich you can expect a no-nonsense approach to things, and you won’t have to worry about penny pinching with Sethi’s advice. He’s much more on the “earn more” side of things, like YAM is.

Contained in this book is a six-week program to help you take control of your financial situation through practical advice that will also help you increase your income.

Recommended for…This book is specifically for those ages 20-35 and addresses some of the more common questions young adults will have regarding paying off student loans and investing.

_____________________

Whether you’re new to money management or want to take your skills to the next level, this list of books has what you need. Just make sure to apply the knowledge you gain – don’t be a passive consumer.

What money management books helped you reshape the way you look at your finances?

So many great books to add to my reading list! You’re right in that personal finance can be overwhelming to start. Books and blogs are great resources – that’s how I started to learn about money!

Thanks Rachel! Yes, I love blogs for that reason, too.

I’ve heard so many great things about The Richest Man In Babylon. I’ve seen other PF bloggers give away the book for free. I’ll definitely have to check that one out at some point.

Hey Erin,

Thanks for the recommendations – I’ve only read the millionaire next door, which was a great book. Some of our family would really benefit from reading some of these.

Tristan

I find these titles interesting, when I understood that was time to think about my future, my saving I used a lovely christian book: Good $ense budget course: Biblical financial principles for transforming your finances and life

Thanks for this list, Erin! I’m ashamed to say I own, but have never read, The Millionaire Next Door. I hear it’s a classic! In excited to get reading!

I really tried hard to read the Richest Man in Babylon but I fell asleep. Literally. I was in bed reading as I usually do and I woke up with my kindle on my face. It does have some good money lessons though. Maybe I should read it somewhere where it would be impossible to fall asleep and command my full attention;)

I’ve read a few of these books. The Richest Man in Babylon starts off slow, but it picked up a bit. It’s definitely not for everyone though.

Thank you for this list! I have already pegged the one I want to recommend to my teaching colleague who would like to spearhead a financial literacy course at the high school level (Why Didn’t They Teach Me This At School?), the one I want my daughters to read (I Will Teach You To Be Rich), and about 3 that I would like to read (starting with The Millionaire Next Door).