This post is by our regular contributor, Kristi.

This post is by our regular contributor, Kristi.

People who want to retire early, or, at least, earlier than 59 ½, worry about how they’ll be able to fund their early retirement. After all, there are huge tax disadvantages to withdrawing retirement assets early.

What if I told you that there is a way that you can have your proverbial retirement cake and eat it too?

The IRA conversion ladder method will help you retire early by giving you access to the funds that you need, sooner than 59 ½.

A conversion ladder isn’t an overnight solution, though.

First of all, you need to have money in a traditional IRA. You also will have to plan ahead and be willing to wait for five years before you’re able to access your money.

If you’re willing to wait, five year is a small price to pay for avoiding the 10% early withdrawal tax typical of retirement accounts. By planning to use an IRA conversion ladder in advance, you’ll avoid that 10% tax, have access to your money, and be able to fund an early retirement.

What is an IRA conversion ladder?

The IRS permits any person to withdraw money tax and penalty free from their retirement accounts if that money was converted from a traditional IRA to a Roth IRA. It’s not a free for all, though. You have to wait five years from the time of conversion to withdraw the money, and you have to pay income taxes on the full amount converted at the time of conversion.

The idea behind a Roth IRA Conversion Ladder stems from this tax and penalty free withdrawal after the five-year wait. To take advantage of this 10% tax avoidance and make the conversion rule work for retirement, you’ll have to continue converting money every year until you’re 59 ½.

Convert one year of living expenses from your traditional IRA to a Roth IRA, and pay the taxes at conversion. After five years you can withdraw that amount from your Roth IRA without penalty. Withdraw one year’s worth of living expenses from your Roth IRA, and continue making and taking conversions until you reach 59 ½.

How much will you need annually in retirement?

For a conversion ladder to be able to help you retire early, you have to know how much money you will spend each year in retirement. If you have no idea, Personal Capital is a great tool to help you figure it out. Use the app or website to track your expenses and create an estimated annual budget.

You could also input your information into a retirement calculator. Either way, for a conversion ladder to be a successful strategy, you need to know how much money you will need to have access to.

Set up your conversion ladder once each year

If you want to be able to live on your Roth conversion money, you’ll need to set up your conversion once each year until you reach 59 ½.

Let’s say that you reach 50 and decide that you want to retire in five years. You would need to convert enough money each year for five years before you want to retire, as well as the 4 ½ years before you reach traditional retirement age and could access your account.

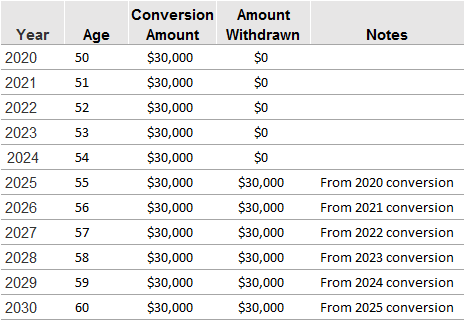

If you decide that your annual expenses are $30,000 per year, you’ll need to convert $30,000 each year starting at age 50. For example, going with that plan, you’re conversion ladder would look like this:

Setting up a conversion ladder is pretty simple

Setting up your conversion ladder is a process that shouldn’t take more than 15 minutes each year. If you’re pretty savvy with your retirement accounts, you can do it yourself. If you feel like you need assistance, contact your bank or speak to someone with your brokerage account and ask them to help make a conversion from a traditional IRA to a Roth IRA for you.

Once you start building your ladder, you’ll be able to access the money after you’ve met the five-year wait limit and start funding your early retirement.

Do you want to retire early? Have you ever looked into establishing an IRA conversion ladder? If not, how do you plan to fund your early retirement?

Good breakdown Kristi. I know these have become more popular over the past few years – I’ve actually been reading how you can potentially use funds from a Solo 401(k) to do a conversion ladder – which would be huge. That being said, my concern is that the IRS is going to clamp down on this at some point if it continues to grow in popularity.

This is very interesting. I love learning about new financial strategies via this site. I’m not sure this plan will work for us, but it’s something to consider, maybe on a smaller scale.

Thanks for the breakdown. I’ve read about this topic on some early retirement blogs but never really delved into the nuts and bolts. I would like to retire early, but not too sure it’s going to happen if I stay in NYC. I will definitely retire earlier than the norm since I will have a government pension at 55 and 30 years. Not sure the conversion would work for me since it would be best to convert in low/no income years.

I’ve been thinking about creating an IRA account lately, and been debating between Traditional and Roth. I have a few questions for your example: a) At the year of conversion, is the $30,000 treated as regular income? b)During the five year wait period, I assume the $30,000 will be invested. Can you only withdraw exactly $30,000 at the end of the five year period? Or you can withdraw the $30,000 plus the invested returns?

Thanks for the article! Exactly what I needed!

Terrific article and excellent advice for those seeking to avoid the penalty of early withdrawal. A friend of mine just took advantage of this and yes it takes some planning. But it’s worth it to avoid the 10% early withdrawal.

FrugalRules I wouldn’t be surprised if they did. Whenever anything financial gains in popularity they clamp down on the rules. Very much like peer to peer lending will continue to see changes.

Harmony@CreatingMyKaleidoscope I’m glad you found the article helpful!

Andrew LivingRichCheaply At least you know your options, though. It’s best to go into retirement (early or not) knowing the different possibilities that you might have to help fund your living expenses.

Laura Beth @ How To Get Rich Slowly It’s a shame that there isn’t more information readily available about this concept, but I’m assuming it’s due to the fact that it’s still a fairly new financial method. Like John said, however, I’m sure we’ll see and hear more in the coming years as more people start to utilize this process or the government decides to set new regualations.

Charlie_15 From what I understand, the conversion ladder only works if you are transferring your money from a traditional IRA to a Roth IRA. You have to pay the tax on the amount converted, but I’m not sure if it’s considered income tax or falls under a different tax. I would have to look deeper into an answer for you question.

David, do you know the answer to this? Are you able to withdraw the invested returns as well or only the amount converted?

Great post about the concept but you are missing important part of this: taxes. If you need $30,000 per year you would need to convert more than $30,000 as this full amount would be taxed. If you were to assume a 15% tax rate and no state taxes you would actually need to convert $35,294. Of course it would be a good idea to run this by an accountant make sure you are getting the numbers right but just keep in mind that converting $30,000 doesn’t net $30,000 after taxes unless you have some real magic going on tax-wise.

That’s a great point. I will try it for myself.