This is a sponsored post on behalf of PayPal Credit. While I was compensated for publishing this post, all opinions are my own.

This is a sponsored post on behalf of PayPal Credit. While I was compensated for publishing this post, all opinions are my own.

One of the benefits of living in the 21st century is we are constantly seeing innovation. Whether it’s a new way to look at ride-sharing (Uber versus traditional taxis) or new ways of communicating (text messaging & emailing versus calling), there are innovations taking place in virtually every industry.

Finance is no different. Companies are always trying to make consumers and business owner’s finances easier to manage through products that are simpler and straightforward.

There has been recent research that shows that millennials don’t like credit cards. More than 6 out of 10 millennials do not have credit cards. Millennials do not trust financial institutions, but PayPal is the most trusted partner for mobile payments ahead of traditional credit card providers and other technology companies. Additionally, nearly 70 percent of millennials are more likely to trust companies that are technology based.

PayPal has responded to this trend through their PayPal Credit product. PayPal Credit is a good alternative to traditional credit cards. It offers a simple and fast payment options and terms.

I recently tested out PayPal Credit and I was impressed by how simple it was to set up as well as how I could view and manage PayPal Credit within my PayPal dashboard.

Besides its ease-of-use and integration with PayPal, PayPal Credit has a couple of big advantages over traditional credit cards:

- Six-month interest-free grace period on orders of $99 or more

- PayPal Credit’s Easy Payments system allows consumers to divide larger purchases into equal monthly payments

PayPal Credit comes with the same zero-liability protection that most traditional credit cards carry. You will not be on the hook for fraudulent activity affecting your account.

Signing up for PayPal credit is easy and a decision is made within seconds. Because it is web-based, you do not have to wait for a physical card to arrive before you can start utilizing your account.

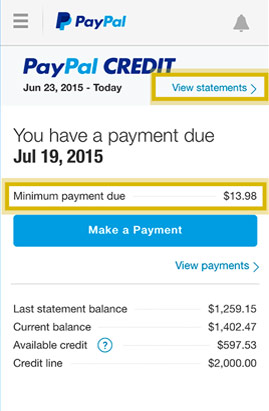

Below you can see how PayPal Credit is integrated with your regular PayPal account:

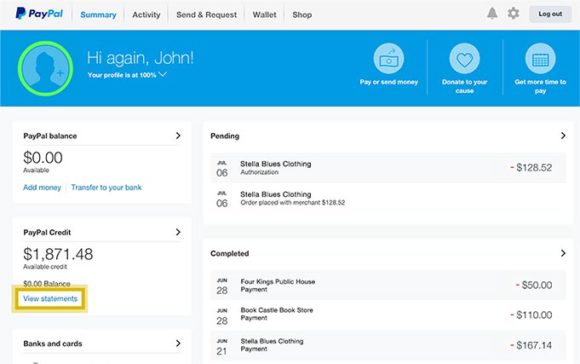

And below is an example of what PayPal Credit looks like on a mobile device:

Head over to the PayPal Credit website to sign up. Once you are signed up for PayPal Credit you will be able to use it almost anywhere PayPal is accepted. You simply choose the PayPal Credit option at checkout and it will charge against your PayPal Credit account instead of your regular PayPal.

Have you heard of PayPal Credit before? What is your favorite trend in Financial Technology that you’ve seen the past few years?

_________________________

Photo by Epicantus

I had PayPal credit when it was known as Bill Me later. I paid it off shortly after it’s conversion to Paypal credit. I don’t have anything bad to say about it.

Jason @ The Butler Journal Good to hear, Jason! It’s a super convenient source of credit. I can see why millennials are shifting towards it.