I haven’t had much time to read the past few months. Work has been busy and studying for the GMAT and preparing my MBA application has made it nearly impossible to find time for reading books.

I haven’t had much time to read the past few months. Work has been busy and studying for the GMAT and preparing my MBA application has made it nearly impossible to find time for reading books.

I take the GMAT in less than two weeks and plan on using some of my freed-up time to read a few personal finance books.

As a personal finance blogger I’ve read many personal finance, investing, and business books, but there is always more to learn. Hearing unique perspectives of the authors of each book is something I enjoy.

Today I want to share 5 personal finance books on my “to read” list. I also would love to hear in the comments what personal finance books are on your “to read” list.

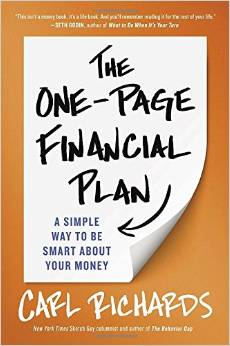

1) The One-Page Financial Plan by Carl Richards

If you aren’t familiar with Carl Richards, he is a certified financial planner and a columnist for the New York Times.

If you aren’t familiar with Carl Richards, he is a certified financial planner and a columnist for the New York Times.

His new book, The One-Page Financial Plan aims to help people understand the “big picture” of their finances and to put together a plan that is reflective of their long-term goals. He recognizes that most people do not have the time to understand the vast amount of financial information available and end up doing “nothing” in order to avoid doing the “wrong thing.”

In Richards words, “My goal in writing this book is to pull the curtain back a bit: to show you how real financial planning works, to give you an experience of what it’s like to work with a real financial advisor.”

I read Richards’ previous book, The Behavior Gap, and really enjoyed it. I’m looking forward to reading his new book, The One-Page Financial Plan, which is already waiting for me on my office bookshelf.

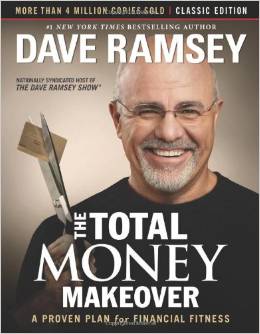

2) The Total Money Makeover by Dave Ramsey

Dave Ramsey’s The Total Money Makeover is by far the most famous personal finance book on the market. Nearly everyone has at least heard of Dave Ramsey and over 4 million have purchased The Total Money Makeover.

Dave Ramsey’s The Total Money Makeover is by far the most famous personal finance book on the market. Nearly everyone has at least heard of Dave Ramsey and over 4 million have purchased The Total Money Makeover.

Dave Ramsey has helped countless people get out of debt and build a solid financial future. One thing he talks about are the “7 Baby Steps,” which include funding an emergency fund for 3-6 months and “snowballing” debt.

Additionally, Ramsey advocates a cash envelope system to control spending (he even sells deluxe materials for it. Ramsey is also an advocate of paying off home mortgages, which I know is a concept many people are a fan of.

My wife won The Total Money Makeover in a giveaway a year or two ago and so far neither of us have cracked it open. We know a number of people who have gone through his Financial Peace University and had good experiences with it.

I have mixed feelings on Dave Ramsey’s approach to personal finance, but it’s unfair for me to criticize (or have an opinion, really) until I’ve read his book. I hope to get to it this Summer. Who knows? I may end up being a huge fan.

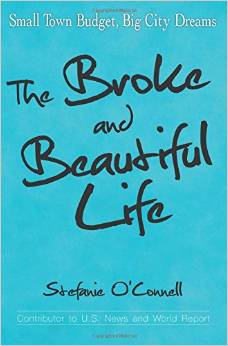

3) The Broke and Beautiful Life by Stefanie O’Connell

Stefanie O’Connell is a friend and blogger whose work I’ve been reading for nearly two years now. She writes at The Broke and Beautiful Life and recently wrote her first book, The Broke and Beautiful Life.

Stefanie O’Connell is a friend and blogger whose work I’ve been reading for nearly two years now. She writes at The Broke and Beautiful Life and recently wrote her first book, The Broke and Beautiful Life.

Stefanie moved to New York to be an actress on Broadway and was quickly forced to gain an understanding of finances and figure out how to best manage her income. What I appreciate about Stefanie is how “real” she is when it comes to finances. With that being said, she also has an attitude of “why not?” and constantly challenges the status quo.

The book is specifically focused on millennials who shy away from personal finances. Her goal is to make millennials realize that having an understanding of personal finance is a powerful tool that can greatly improve your life.

I’m excited to check out her book and read about how her experiences influenced and motivated her to have a better handle on her finances.

4) Zero to One by Peter Thiel

Peter Thiel is most famous for founding the company PayPal in 2002. In his book Zero to One he talks specifically about entrepreneurship and startups.

Peter Thiel is most famous for founding the company PayPal in 2002. In his book Zero to One he talks specifically about entrepreneurship and startups.

While this book is not focused on personal finance, I think it’s still a valuable book for people to read because it can be eye-opening to current and would-be entrepreneurs. Here is a good summary of Thiel’s main premise:

“Doing what someone else already knows how to do takes the world from 1 to n, adding more of something familiar. But when you do something new, you go from 0 to 1. The next Bill Gates will not build an operating system. The next Larry Page or Sergey Brin won’t make a search engine. Tomorrow’s champions will not win by competing ruthlessly in today’s marketplace. They will escape competition altogether, because their businesses will be unique.”

I started to read Zero to One but had to quit when I started studying for the GMAT. I was a few chapters in, so I look forward to reading the rest of it when my time frees up.

5) The Automatic Millionaire by David Bach

David Bach’s book The Automatic Millionaire was published in 2005 and is focused on how people can become millionaires even with a modest income.

David Bach’s book The Automatic Millionaire was published in 2005 and is focused on how people can become millionaires even with a modest income.

Bach lists the following points that make his approach unique:

You don’t need a budget

You don’t need willpower

You don’t need to make a lot of money

You don’t need to be that interested in money

You can set up the plan in an hour

What is interesting is that you can set the plan up in an hour. If it’s really that simple, how is there an entire book written about it? It must have some sort of valuable information considering it’s 4.2 rating on Amazon from a combined 472 customer reviews.

This book was recommended by a good friend of mine and I was surprised that I hadn’t heard much about it. I look forward to seeing what Bach’s “simple” formula is for becoming a millionaire.

Honorable Mention: Pocket Your Dollars by Carrie Rocha

I can’t help but add Pocket Your Dollars by Carrie Rocha to this list. Carrie is another personal finance blogger who I’ve been able to meet in person at one of our Minnesota personal finance blogger meetups.

I can’t help but add Pocket Your Dollars by Carrie Rocha to this list. Carrie is another personal finance blogger who I’ve been able to meet in person at one of our Minnesota personal finance blogger meetups.

Carrie’s story of overcoming debt and turning around her personal finances is an inspiring one. Beyond that, she’s also built an entire full-time business out of her website, Pocket Your Dollars.

Thousands of people rely on her shopping lists to get the lowest price on things they would buy anyway. I know we check her site each weekend to see what we can get for rock-bottom prices at Target.

My wife read this book a while back (it came out in 2012) and said it was a really good one. Once I finish the first five books on this list, Pocket Your Dollars is the next on the list.

2 Personal Finance Books I Highly Recommend

Besides just listing what’s on my “to read” list, I thought it would be good to share 2 personal finance books I recommend. Both of these books had a big impact on my finances and really how I viewed my life in terms of finances. I don’t just recommend them, I highly recommend them.

1) The Money Book for the Young, Fabulous & Broke by Suze Orman

I’ve read a lot of personal finance books, but there is one book that continues to be my “go to” recommendation for millennials: The Money Book for the Young, Fabulous & Broke by Suze Orman.

I’ve read a lot of personal finance books, but there is one book that continues to be my “go to” recommendation for millennials: The Money Book for the Young, Fabulous & Broke by Suze Orman.

My wife and I both read this book when we were nearing college graduation and we are extremely thankful to have read it when we did. With that being said, I think the book would be useful for anyone who falls in the millennial demographic (ages 18-34). If you don’t fall in this demographic, recommend it to someone who is; they’ll thank you for it!

In my experience, books that try to cover too many personal finance topics end up providing little value in the end. This book is one of the few exceptions where I’ve seen a comprehensive personal finance “guide” actually pan out in the end.

I highly recommend you check out Suze’s book if you haven’t yet.

2) The 4-Hour Workweek by Timothy Ferriss

The other personal finance book I highly recommend to people is Timothy Ferriss’ book The 4-Hour Work Week. While it doesn’t necessarily fit into the personal finance niche, I do think that it can have a huge impact on your finances. Simply being exposed to Tim’s way of thinking can have a material impact on how you live your life and view work, careers, money, and more.

The other personal finance book I highly recommend to people is Timothy Ferriss’ book The 4-Hour Work Week. While it doesn’t necessarily fit into the personal finance niche, I do think that it can have a huge impact on your finances. Simply being exposed to Tim’s way of thinking can have a material impact on how you live your life and view work, careers, money, and more.

I read this book on my honeymoon three-and-a-half years ago and it’s really stuck with me. What I like about Tim is he doesn’t advocate changing the way companies and the economy works. Instead he advises taking advantage of the opportunity that the internet has provided.

Tim is big on “lifestyle design” and I have always thought that personal finances were more about lifestyle than anything else. They dictate our life and either force us to live a life that we don’t enjoy but “have to” live, or they allow us to utilize resources in a way that provides us the lifestyle that we truly desire.

The bottom line is this: if you haven’t read The 4-Hour Work Week yet, I would put it at the top of your list. This is a book that has the potential to greatly impact your life.

Those are the personal finance books on my “to read” list. What’s on yours?

____________

Photo by rosmary

I’ve read a few of these and the rest are on my list. The One-Page Financial Plan is on the top! I read a review of it recently and it’s been stuck with me. I think the graphics are what appeals to me. Also, I do recommend Pocket Your Dollars. It was a quick read, but had some fresh ideas.

Great list. Dave Ramsey has been very helpful to us, and Total Money Makeover is definitely his most “classIc” title. 4-Hour Work Week was also interesting, though I had some critiques. Thanks for pointing out a few newer books, too!

Great list. Total Money Makeover and the Millionaire Next Door are my top two.

LOVE Suze and Tim Ferriss’s books. Next up I’m reading Zero to One – cannot wait!! Nothing better to me than reading personal finance and self-improvement books. If I’m going to read, I ned to learn something.

Your Money or Your Life is one of my personal favorites. I bought Tim’s book last year and have yet to finish it. I think I need to re-read it. Reading is something I don’t make enough time for! :(

SimplySave I’d really like to get to Pocket Your Dollars sometime this year. It looks like a really quick read. I already have a copy of “The One-Page Financial Plan” so I might as well read it sometime soon.

Pretend to Be Poor Glad you liked the list! I really need to get to Total Money Makeover. We may go through it with some of our friends this Fall.

DebtDiscipline I need to get to both of them, definitely “must-reads” in the personal finance blogosphere. It’s interesting how Millionaire Next Door was written so long ago but is still very popular. Must have some lasting principles in it.

Financegirl I’m with you on that. I haven’t read much fiction the past three years besides the Hunger Games trilogy. I’m all about non-fiction books, especially self-improvement ones.

Beachbudget Thanks for the suggestion! The 4-Hour Workweek is becoming a bit outdated (at least the detailed, descriptive explanation of how to go about it) but the underlying principle of passive income is still very much relevant today.

Thanks for including BBL! So honored :)

brokeandbeau No problem! Looking forward to reading it.

I actually recently met with a new couple who were following Dave Ramsey’s plan and unfortunately they are kind of in a mess because they don’t have much emergency cash but they feel good because they paid down their cars. I know that he has helped a number of people, but you really need to keep your debt repayment schedule inline with your near and long term goals otherwise you can get into debt trouble down the road.

Great recs! Dave, Suze, and David are some of my favorite pf authors. I Will Teach You to Be Rich by Ramit Sethi is another one of my faves.

blonde_finance This is exactly why I want to read Dave Ramsey’s book cover-to-cover. I typically join in the criticism of the low emergency fund he advocates, but having not read his book yet I really can’t say anything with any credibility because I haven’t taken everything into context.

NiomiSage Oh I saw that book by Ramit Sethi on Amazon and have heard about it from a couple of others. Definitely another book I hope to check out in the future.

Hey DC, thanks for the booklist, I’m always interested in what people are reading. That Zero to One book sounds really interesting. Like you’ve said already, I have mixed feelings about David Ramsey – I’ve read parts of his Total Money Makeover and liked a lot but didn’t care for others. I’m curious to know what you think after you’re done.

Cool post here DC! Would be good to hear more about your books, although I see we’re mates on Goodreads, which means I can check out the ones you’re reading..

Good luck with you GMAT test and interested to hear your results, sure you’ll get well :)

One of the ones I’m looking to read is Mastering your Money Game by Tony Robbins, I’d like to hear what he’s got to say given the amount of success and impact on the world the guy has had! Wouldn’t mind meeting him one of these days too

LindseyT No problem! I also am always interested in hearing what others are reading. I really need to read Dave Ramsey’s book cover-to-cover very soon. It could very well hold the title of “top personal finance book” for decades to come.

Fun, I haven’t heard of a few of these. Zero to One sounds really interesting to me. I love entrepreneurship and creative thinking books.

Best of luck with the GMAT!

mycareercrusade Thanks for the reminder, I need to update my goodreads! Also thanks about the GMAT. I can’t believe it’s coming up this Saturday already…I really hope it goes well.

I have the Tony Robbins book on my to read list as well! I added it to my Goodreads a couple weeks ago when I was browsing at a book store.

moneypropeller Entrepreneurship is such a great field to read about because you get a lot of creative thinkers giving their input on various topics. From what I’ve heard Zero to One might not give the most practical advice on entrepreneurship, but it does give some great high-level thoughts that are applicable regardless of what business you are going into.

I actually haven’t read any of those 5 books, and thought I had a pretty good personal finance library going! I think the automatic millionaire might be the next one on my personal finance reading list.

Great list! I haven’t read any of these (hangs head in shame), but they all look good. I’m inundated with baby books right now :), but I want to balance those out with a few financial reads too, so I’ll have to check these out from the library. Thanks for the suggestions!

I want to read the 4-hour workweek. Ironically, I’m not sure I’ll ever have time since I work a gazillion hours!

I’ve been meaning to read the 4-hour Work Week forever. I have always like the Automatic Millionaire. Great list.

I really, really need to read Dave Ramsey’s book. For some reason, everytime I attempt to read a book lately it’s like I develop narcolepsy :) I need to see if there’s an audio version on Amazon. I’ve also hear great thing about the 4 Hour Work Week, but always forget about it. Thanks for the rec’s!

I’ve read 3 of the books that are listed above. Secrets of the Millionaire Mind by T. Harv Eker is another one of my favorites.

The Total Money Makeover is on my list as well. I’ve heard so many good reviews about the book and I want in :) I’d also like to read Stephanie’s book as well.

Jason@Islands of Investing Hmm I wonder if there are different books that are popular in Australia as opposed to the United States?? Who knows. I can’t wait to read the Automatic Millionaire.

Mrs. Frugalwoods Wow I’m surprised that you haven’t read any of them! Yes, I suppose your attention is elsewhere with the baby on the way! I know when I have my first kid I won’t be able to consume enough baby-related content.

Holly at ClubThrifty Haha I can’t believe you haven’t read it Holly! Just from what I know about you I would have guessed it was a book you read years ago. You need to read it this Summer!

Eyesonthedollar You NEED to read the 4-hour work week! This year! I am looking forward to reading the Automatic Millionaire. Seems like a good read.

Jason @ The Butler Journal Thanks for the suggestion, Jason! I will have to add it to my GoodReads.

believeinabudget Haha I have had a lot of trouble the past couple years reading books. There just is so many other things on my to do list that I don’t get around to it as much. I would really like to get disciplined this Summer, though, and set aside time specifically for reading books (the ones on this list in particular).

Chonce Its interesting how many personal finance bloggers (myself included) haven’t gotten around to Dave Ramsey’s book. I look forward to checking it out sometime soon.

DC @ Young Adult Money mycareercrusade Still using a bookstore ;) haha? That’s actually cool and sometimes I do interchange between a traditional and kindle book..

Would be good to see a review or shoot me a note once you’re done! I’m planning on making that one of my next books

mycareercrusade DC @ Young Adult Money I have a feeling you will finish the book before me tho, so I will be looking for your review on Goodreads (or you can email me if you feel like being nice haha). I was browsing a bookstore on Mother’s Day while we were on a 2 hour wait for brunch….

Thanks for sharing your list. I have not read any of the books. Now I have more summer reading!

houseoftre I’m glad I could share them with you! If you do read one of them, be sure to write a blog post about your thoughts. Curious to hear how you like them.

Zero to One is definitely on my list. Someone gave me the Tony Robbins book as a gift, but I don’t know if I can make myself read it :)

DC @ Young Adult Money mycareercrusade Haha I’d be more than happy to!

Wow a 2 hour wait that sounds intense :O

Still waiting to buy that beer for you down under too haha! :)

ferventfinance Haha well you would hope someone like Tony Robbins could write a decent book about money. My only concern with his book is that it’ll end up being too generic to be of much value to any one demographic.

The Total Money Makeover is on my list, too! The Suze Orman book you mentioned was actually a textbook for my personal finance course in college and was one of the main reasons why I got so interested in personal finance in the first place!

LisaVsTheLoans Oh that’s awesome! So cool that they used it as a text book. It’s a really solid book for ppl in their 20s.

I haven’t read any of the five although I have read and/or listened to a bit of Dave Ramsey’s stuff. To be honest I find his demeanor hard to handle but that’s probably just me.

I read the 4 Hour Work Week ages ago. I need to read it again. I think I’d ‘get’ it more now than I did then. None of it really felt ‘do-able’ then but I’m sure it will now.

Thanks for the reminder to dig it out and read it again.

DC @ Young Adult Money Jason@Islands of Investing Jason might have a different opinion but as far as I know there hasn’t been a decent personal finance book published by an Australian author in a long, long time. Maybe since Paul Clitheroe…? What do you reckon Jason@Islands of Investing?