I work full-time as a financial analyst and we use “financial bridges” extensively.

I work full-time as a financial analyst and we use “financial bridges” extensively.

If you aren’t a financial analyst you may have no idea what a financial bridge is.

I’ll give a full explanation in just a little bit.

Today I want to explain how using the “financial bridge” technique when setting goals can drastically improve your chance of accomplishing those goals.

What is a “Financial Bridge?”

A financial bridge isn’t as fancy as it sounds. It’s actually something that is relatively simple.

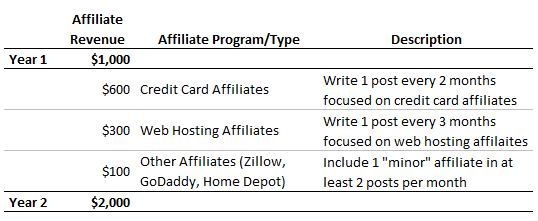

I’ll use my blog as an example. Let’s say that my affiliate revenue is currently $1,000 for the year. My goal is to, say, double my affiliate income to $2,000 next year. For simplicity’s sake let’s also assume that I want to make $2,000 revenue, not profit.

If I was going to create a bridge for this goal I would list out all the actions I plan on taking to turn the $1,000 in affiliate revenue into $2,000. Creating a bridge would force me to create action items.

So what I would do is list out the specific drivers of the revenue increase and create a visual “bridge”:

Not only did I list out where I am forecasting the increased revenue to come from, but I’m also listing out how that revenue will become a reality – publishing more posts that are centered around these affiliates.

Keep in mind that this is an extremely simplified example. Creating financial bridges gets much more complex when you are forecasting for a business. Typically there will be revenue, expense, depreciation/amortization, and income for each line item.

Using the “Financial Bridge” technique when setting goals

You can use the financial bridge technique for goals that are both financial and non-financial in nature. It doesn’t have to be a business goal, either. It can really be used to lay out an actionable plan for any personal goal you might have.

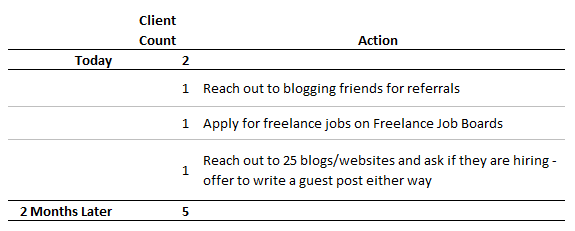

I’ll show another example to give you a better idea of how this could work for a non-financial goal. Let’s say I want to gain 3 additional freelance writing clients within the next two months. What actions do I have to take that realistically will result in gaining 3 new clients?

Here’s what I came up with:

One reason I think using the financial bridge technique is useful is because people like to talk about goals but not on how they plan on achieving them. A financial bridge forces you to visualize how you will achieve your goals.

It also forces you to think about whether or not your assumptions are realistic. If someone wants to own a $750,000 house in one year but currently only has $5,000 in their bank account and makes only $30,000 a year, a financial bridge would be difficult to populate.

Likewise, if a goal seems like it will be easier than expected to accomplish it may be time to think about a “stretch” goal, in other words something that will be difficult to achieve but still realistic.

What are your thoughts on using the “Financial Bridge” technique to accomplish goals? How do you hold yourself accountable to your goals?

____________

Photo by David Swart

Accountability is a powerful thing…….I once did an exercise where I took a picture of everything I spent my money on over a weekend. Then at the end of the weekend I reviewed what I purchased by looking at the pictures. When you stare a bad purchase in the face, it certainly gives you something to reflect upon. Similarly, when you stare at your goals, it makes you really think about a.) whether they are achievable, and b.) whether your plan to achieve them is feasible.

Agreed, for every goal there have to be concrete action steps in place. Otherwise it’s just a wish.

“Financial Bridge” seem very straight forward, your are defining an action plan to achieve your goal.

I like the technique! I’ve never heard the specific term, though have used something very similar for a number of years when working on my goals. I like doing so for the exact reason of being able to visualize how I’m going to reach whatever goal it is. Having those steps laid out allows me to see whether or not it’s feasible, not to mention some accountability.

DebtChronicles Wow that sounds like a great little experiment. I know I’d look at more than a few things I regret buying, especially if I did it over a longer period of time (like a week). I think people need to stare at their goals more often!

brokeandbeau Definitely, and it’s easy to make a wish. Not everyone is disciplined enough to follow through with a plan, but at least you have a way of holding yourself accountable to the goal.

DebtDiscipline It definitely isn’t that complex on a personal finance-level, but the most important thing to remember is that you are writing down a plan of action. You can’t simply say “I don’t know why I didn’t achieve x y z goal,” as you have the bridge to refer to.

FrugalRules I thought of it recently while working on a financial bridge at work. I realized that some of my goals are lacking that plan-level detail that can hold me accountable to accomplishing my goals.

It’s like you’re your own coach and what you want may just not be as difficult as you had imagined. Solid technique! :)

I like the idea of the financial bridge. I need to use it because I have a couple big goals that I want to achieve in 2015. Any type of motivator will help.

I like it DC, I use this stuff all the time. I also think focusing on one specific goal is very important. For example if your focus was just achieving an extra $1000 per month you should only do things that contribute to you making an extra $1k, anything else should be dropped. That gets you super laser targeted focused. Think to yourself “how is this helping me get to $1k?”

I’ve also heard these called “waterfalls” and “crossovers,” although I like this term the best. I think it’s a fantastic idea to apply to our personal finances. It’s also a good way to reflect on the past and see how we ended up where we did.

I like the concept and terminology. Bridges help us get where we want to go and in a much shorter period of time. Without them we may have to take the long way around, end up wasting time and potentially never get there at all.

Wow that sounds like a great idea DC, it actually gets your mind very laser focused on how you will achieve said outcome and then if you put in the work the outcome is not something you’ll be attached to.. After you then do the action items if it doesn’t reach your desired outcome then it’s probably about reviewing, revising and adjusting the goals to see why it didn’t work and how your technique or method could be modified to create a different action..

Cool post and I’d say this should work for most people as the what is important but the how and then why is just as important as well.. Normally I know what I want to achieve but can struggle a bit of holding myself accountable, the financial bridge technique would help :)

kay ~ lifestylevoices.com Thanks Kay! Maybe I just spend too much time in spreadsheets working in finance, but the bridge can be a great way to hold yourself accountable.

Jason @ The Butler Journal Yes I would definitely recommend you make a bridge for your goal! Remember to include the time “cost” so you can stick to a realistic plan. It’s easy to get in over our heads.

Derrick_Horvath Great tip! I think there is something to be said about being laser focused on accomplishing a goal. Too often people stretch themselves too thin by setting a large number of goals and they end up accomplishing none of them.

Mark@BareBudgetGuy Yep I work with “waterfalls” as well. I think bridges are a good way to keep yourself accountable. Did you reach your goal? Why or why not? Was the goal unrealistic or did you simply miss some of the benchmarks? Definitely worth doing some retro analysis!

Brian @ Luke1428 Wow you just took my analogy to a whole new level. If only I had thought of that when I was writing this haha

mycareercrusade I don’t spend nearly as much time as I should doing “retro” analysis, looking back at what I did and why I didn’t reach a specific goal. Sometimes it’s a lack of time or capacity, but other times it’s because I was doing things that I shouldn’t have been – a lack of priority and discipline.

I love how detailed this method is, and how it easily breaks everything down into simple, actionable steps. You’re right that too many people fail to focus on their goals because they don’t take the time to map everything out. You absolutely need a plan in place, otherwise nothing will get accomplished, and you won’t be able to hold yourself accountable.

Oh man, I’ve done plenty of these financial bridges in my time too! They are pretty great visuals though, and I like the application to goal setting, focusing on the specific steps to get there. I think I’ll take this advice on board and use my financial bridging skills to some goal setting!

Erin @ Journey to Saving I’m glad you like the financial bridge method. I think a lot of times some of the practices that are in place at businesses can be applied to personal finance. Tracking progress on goals and holding yourself accountable to a plan is a good way to actually accomplish goals.

Jason@Islands of Investing Gotta love financial bridges ;) It really is a great way to plan goals and benchmark goals. Makes it easy to hold yourself accountable, too.

Love this DC! And I agree, a lot of people create goals, but they don’t create the action steps/implementation plan to actually achieve their goal. While a financial bridge won’t guarantee goal success, it certainly improves the probability. You can see whether you’ve stretched too far or perhaps not enough. And anytime you can create tangible makes it so much easier to take action. I’ve seen lots of people get stuck in the thinking about/dreaming about stage. :)

ShannonRyan I agree that so many people are stuck in the dreaming stage. You really need an action plan if you wan to accomplish goals. It really helps with accountability too.

I LOVE this post, DC. I have never made the connection before, ever. I started a separate spreadsheet, just for this, to be the master plan for all of my sites. I need ideas for another $2k of revenue, though!

moneypropeller Thanks, I’m glad you liked the post! The connection just kind of hit me one day when I was doing a financial bridge at work. There’s a reason they are so widely used in the corporate world – they are very effective for mapping out goals and instantly create accountability.