One of my goals this year is to get life insurance. I set this goal over seven months ago.

One of my goals this year is to get life insurance. I set this goal over seven months ago.

How much time have I put towards this goal so far? Absolutely none.

This is NOT a good sign. It means I’m making it a low priority. In reality, it’s something I should be making one of my top priorities.

My main issue with life insurance has always been that it’s time consuming to get. Thankfully, I finally found the fastest way to get life insurance and I can’t wait to share it with you.

First I’d like to share some of my personal thoughts on life insurance, as well as why I kept putting off getting it.

My thoughts on life insurance

I should probably explain why I feel that life insurance is extremely important. It’s kind of a morbid/strange insurance, since it kicks in after you pass away, but it’s essential if you have a significant other and/or children.

I read Suze Orman’s book The Money Book for the Young, Fabulous, and Broke a few years back and it was the first time I ever really thought about life insurance.

One thing Suze said to do was to get more life insurance than you think you need. Some people get enough life insurance to cover their mortgage, auto loan(s), and student loans; others don’t even get enough to cover all their debts.

Suze made a great point, though, that if you passed away unexpectedly it would be a traumatic event and you can’t know to what degree that will affect your significant other. You want to make sure that not only your debts are covered, but also that your spouse will have enough money to not work. I agree with this approach.

Why I kept putting off life insurance

With the huge benefit that life insurance provides – namely the peace of mind knowing your significant other and children are taken care of in the case of an unexpected tragedy – why did I put off getting life insurance for so long?

To be honest it was pure laziness. I continued to make it a low priority because I knew it would take some time and effort to get. It’s not as easy as getting an auto loan, which only required me filling out two pages worth of information (online). The money was wired to me just a couple hours later. The life insurance industry doesn’t work that way, unfortunately.

I recently heard that over 85% of life insurance is still sold over the phone or in person. Considering how insurance and other financial tools have become much more automated these days, that’s a crazy high number. The thing is, most 20- and 30-somethings simply do not find this approach appealing (at least I don’t!). We want things to be web-based, quick, and simple.

A physical may be unavoidable for life insurance, for obvious reasons. That doesn’t mean the rest of the process can’t be easier, though.

So the two reasons I kept putting off life insurance were:

1) I made it a low priority

2) The process seemed time-consuming

I think we both know that my first reason is invalid: life insurance should be a priority! The second excuse, though, I just recently found to be invalid. That’s because I found the fastest way to buy life insurance.

The fastest way to buy life insurance

I recently heard about a new company called Quotacy. Their entire philosophy on life insurance is this: it should be quick and easy to get a quote. That sounded good to me, so I figured I might as well give it a shot.

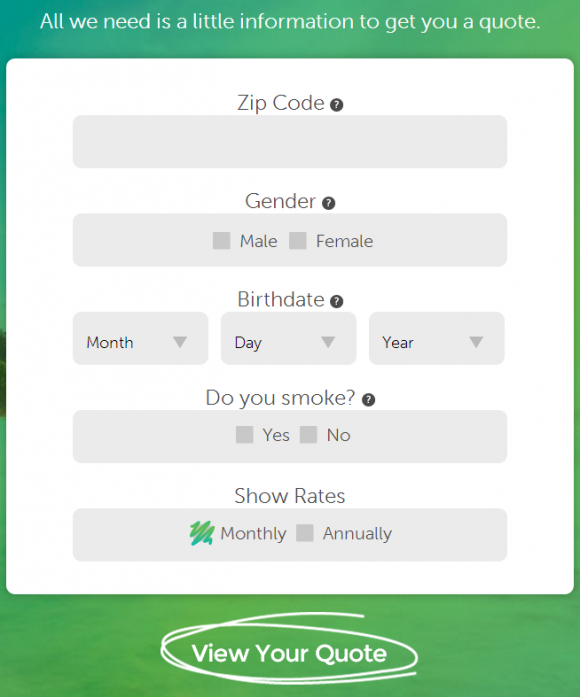

The first thing they asked for was some basic information about myself.

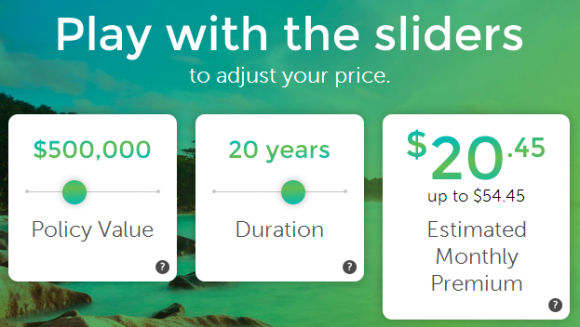

This next section was my favorite. It had two sliders – policy value and duration – and gave quotes of estimated monthly premium based on what you choose for the slider values.

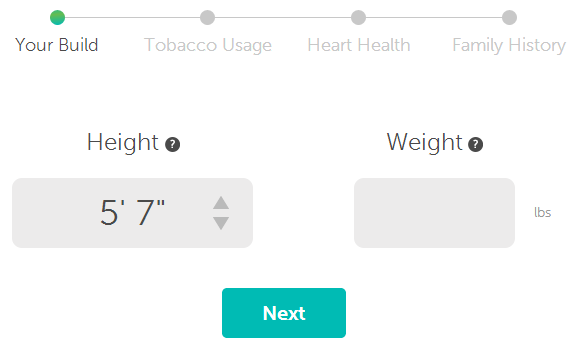

Next they asked some health information. These were literally just quick, short questions that took less than a minute (total) to complete.

And just like that I had quotes from a variety of insurance companies.

There were many more quotes on the page, but you get the picture. With this tool you get quotes really quick.

Quotacy will review your online submission and work with you if needed to make sure you’re applying with the company that will give you the best price based on any unique health or lifestyle characteristics.

One thing I should mention is that your policy is not automatically in force after submitting your application online, the insurance company you choose will still have to approve your policy, and there might be a few follow up questions here and there.

With that being said I think the tool that Quotacy has put together is great. It’s straight-forward, easy, and all web-based. I personally prefer this to sitting down and talking to a salesperson who is paid on commission.

If you haven’t gotten life insurance, what is holding you back? Would you consider using Quotacy for life insurance quotes?

_________________________________________

Photo by David Amsler

I think you’re concern in #2 is valid because life insurance is complicated. Is Quotacy giving you quotes on term insurance or whole life insurance or both? Have you decided which type of insurance you are going to get? Are you partially insured by your company? Some companies given 1 or 2 x salary as part of your benefits plan, but that is not enough to cover what you need so I supplement it with term insurance. Good luck!

Ever since we got a mortgage my wife and I have both been covered by life insurance. Now that we have a little boy, that insurance is more important than ever!

I’ve had life insurance for a long time and got it through a similar site. It did recall a phone call and physical but a nurse came to my house to do it. Well worth the effort!

Great overview DC. I can defiintely relate. I know I need to educate myself more about life insurance and seriously consider getting a policy. At 25 it definitely isn’t my favorite thing to think about. Then again, I think it would give me some peace knowing that I am taking care of everything far in advance.

We got life insurance in our mid-20’s then added more once we had kids. I feel like we are adequately covered now and I’m glad to have it behind me!

Interesting…so do you still have to get the physical? I’m worse than you…I’m a little ashamed to admit that I didn’t get life insurance, and I have a wife and baby. Plus we will be taking on a mortgage soon. But I do have coverage at work which is pretty good, though it’s better to have something not tied to my employment. The part you mentioned about Orman’s book regarding covering debts…I don’t think student loan debt continues after the death of the student unless you had a guarantor…that’s my understanding at least.

I never thought much about having a life insurance until I read a story about a nursing student who died unexpectedly and left her Dad over $100,000 in student debt. To be honest it’s not something of my priority now, but I’m gathering information about it, so thanks for sharing :)

The DH and I have only held life insurance for the past three years. I did have a policy through my employer prior to that. But the driving force for us to purchase it was to provide for my step-son in case we were to die before he is able to take care of himself financially.

I’ll be sure to check this out. The Mrs. and I each have 2 life insurance policies- one through our employer and one through the other’s employer. We have very little debt, so it would be more than enough to cover it, but not enough to be “comfortable.” I’ve considered how much I would want, and am okay with the current amounts. I think once we have a kid, I’m definitely going to need to increase it… a lot.

I have been looking to get more insurance. I just tried out the site, but they don’t sell in my state. That is usually how it goes!

debt debs Term. And yes, I am getting term for sure. And yes, I am partially insured by my company, but it’s not nearly as much coverage as I want.

MonsterPiggyBank We have student loans and a mortgage so I definitely want both of us covered. Not a fun thing to think about, but the insurance does provide peace of mind.

Eyesonthedollar My friend had a nurse come to his house to do the physical as well. That seems much more convenient than having to find time to go to the doctor’s office.

BudgetforMore I agree with you on the fact that it’s not fun to think about, but being married and a homeowner it’s essential to get coverage imo.

Holly at ClubThrifty Nice, sounds like you got it around the same time we are getting it. It’ll feel good to have the added security.

Andrew LivingRichCheaply I’m fairly certain you still need to get a physical. Interesting point about student loan debt. I feel like a lot of 20somethings these days NEED to get a co-signer simply because it’s so expensive to go to college these days.

PoorStudent Ah that’s a terrible story, but I’m sure all-too common (though maybe for less than 100k). I spent quite a bit of time gathering info before buying. Now it’s just a matter of getting both of us covered so we don’t have to think about it!

MoreThanJusMony That makes a lot of sense. My employer offers a plan, but it’s not that great. I’m looking to get a very high amount of coverage.

ImpersonalFinance While you may have very little debt, I’d factor in what a traumatic experience it would be to lose your significant other. It could have significant impact on your career/income if it ends up taking you a long time to recover emotionally.

DebtRoundUp Ah are you serious? I’m curious as to why they don’t sell in your state? Regulations?

DC @ Young Adult Money NC has a wealth of crappy regulations that don’t make any sense. It wouldn’t surprise me. It could also be they just never got licensed here.

I am a big believer in life insurance, especially if you are married and double especially if you have kids. I have not heard about this site, but it sounds awesome. Many other insurance comparison sites are difficult to use and do not necessarily give you a quote indication after you put in your information.

DebtRoundUp

Hi @DebtRoundUp! Thank you for visiting Quotacy! Thanks to your post, NC is now turned on for quoting! Give it a try now!

WE haven’t

TeamQuotacy DebtRoundUp That was quick!

NewlywedsonaBudget Yes, but that’s the whole point. If it did happen to you – and hopefully it won’t – you don’t know what state you’d be in. Would you still be able to emotionally continue working 9-5 soon after an unexpected death of a spouse? I don’t think anyone can answer that, but it’s certainly possible (I’ve seen it firsthand).

blonde_finance That’s been my biggest complaint when shopping for life insurance. I don’t really want to sit down face-to-face with a salesperson, nor have I found a site that lets me do it all online, on my schedule.

DC @ Young Adult Money NewlywedsonaBudget maybe not right away I wouldn’t return to work, but his policy through work would be enough to last for at least a year if I did need to take some time off. I just have a problem with paying $100 a month for something that I have a 99% chance of not using. I’d rather invest the money to create a sizeable nest egg that I wouldn’t need to depend on that. Like I said, we will get some in the future when we have more dependents, but I don’t think life insurance is the magic potion some people make it out to be.

Luckily, I have life insurance policies through my previous employment where I pay a higher premium now that I do not work there.

MCAWriter That’s great. Many employers offer health insurance, but I am of the opinion that the amount they offer is not nearly enough.

NewlywedsonaBudget DC @ Young Adult Money I’m going to have to disagree with you. I don’t know your situation, but for many a premature death of a spouse can literally derail a career. I saw it happen in college when a librarian eventually had to leave the University permanently because she was still having difficulty recovering from her husband’s tragic death.

I don’t think life insurance is a magic potion, but it does insure you for the worst case scenario. Investing $100/month isn’t going to do much if your spouse passes away 3 years from now. But if you bought a policy and the worst case scenario did happen – you’d have a lot more than $3,600 + interest to live off of.