I think that in almost every situation it makes sense to pay the minimum on student loans.

I think that in almost every situation it makes sense to pay the minimum on student loans.

Hear me out before you start firing off a comment about what terrible advice this is.

If the goal is to build wealth – and I don’t know many people who don’t have that as a goal – it makes sense to take advantage of things that help you improve your wealth.

Whether it’s saving money on travel through travel hacking, consistently clipping coupons to save money on groceries, diversifying your income through dividends, or something else, it’s important to recognize opportunities to build wealth.

I think student loans offer a unique opportunity for people to leverage their debt to build wealth. I won’t talk about whether or not you should take out student loans because that’s simply not my audience. People who read this blog have already gone to school and likely have student loans.

If you don’t have student loans you can apply this to other debt, but I used student loans in this example because the interest rate fits nicely into my model. Plus the site is called “Young Adult Money” so I’m assuming a ton of people who make their way here are dealing with student loan repayment.

I want to start by establishing some assumptions. In a previous post where I advocated not paying more than the minimum I got about 47 negative comments where people disagreed with me and about 3 that agreed with me. That’s not a great ratio. This time around, I’ll save a lot of people time because I’ll take a few “counter-arguments” off the table from the get-go.

Here’s the assumptions:

1) An 8% rate of return on money invested in the stock market

I could easily use 9% instead of 8% and still have plenty of support for using that rate. Instead I use 8% as a “conservative” measure of average market return. I spent an entire post building an argument for using this rate in financial calculations, so if you have an issue with it please head to that post to complain.

2) A less-than 8% rate on student loans

In this model I’m assuming less than an 8% return. If your student loans are higher than an 8% interest rate it very well could make sense for you to pay more than the minimum. I haven’t met anyone with student loans that are higher than 8%, though, so for all practical purposes we will assume student loan debt is at a rate lower than 8%.

3) Just math, no psychology or emotion

It’s undeniable that personal finance is an emotional and psychological topic. There’s a reason that Dave Ramsey advocates paying down your smallest debt first instead of the one with the highest interest rate, and it has a lot more to do with emotions than financial equations.

If you strip out the emotion and psychology, though, you are left with a financial equation. If the other assumptions in this model are accepted, you have the variables needed for the financial equation. There’s not much more to it than that.

4) Instead of putting extra money towards student loans, it’s invested

Yes, it’s pivotal for this equation that you siphon the money that you would put towards your student loans into the stock market. Everyone’s budget, finances, and lifestyle varies. I’m not pretending that these assumptions apply to everyone.

5) 10 year payback time frame

Student loans vary in the amount of time that you can have them out. This model does not factor in income-adjusted repayment or loan deferrals. I use a 10 year repayment time frame because that’s a fairly typical time frame for student loan repayment.

__________________________________________

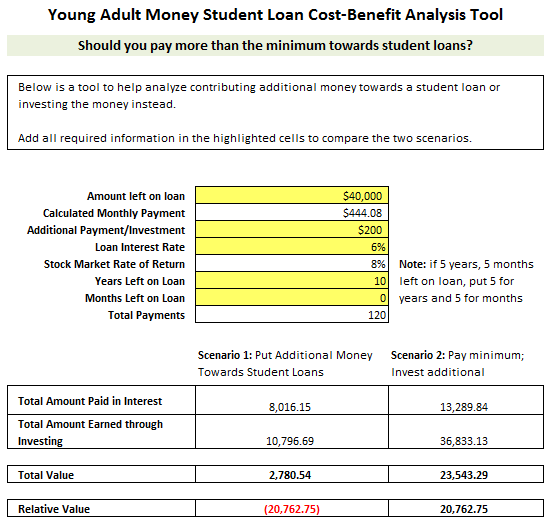

So now that we have all the assumptions laid out let’s run the numbers. Using a template that was (greatly) modified from my 401k cash-out spreadsheet we can see how the numbers stack up.

To start, you need to plug the following numbers:

- Amount left on loan

- Calculated Monthly Payment

- Additional Payment/Investment

- Loan Interest Rate

- Stock Market Rate of Return

- Years Left on Loan

- Months Left on Loan

For this example I used a 10 year, $40k loan at a 6% interest rate. I plug a sample $200 extra payment per month. In the model I have two amortization tables on two separate tabs. The first amortization adds an additional $200 payment each month to the minimum loan payment.

Once the loan is gone, it starts putting $200 into an investment account. This allows for an apples-to-apples comparison to the second amortization table, which only pays the minimum on the loan and puts $200/month in an investment account.

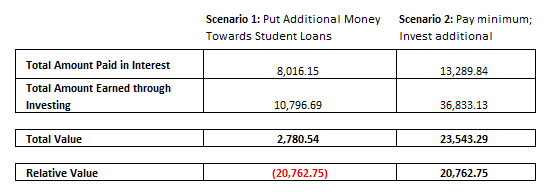

Taking the ending investment balance (monthly deposits plus interest) minus the total interest paid, we can see that it can be much more valuable to not put anything additional towards the loan and instead invest it. In fact, you are missing out on $20,000 of value if you decide to pay additional money towards your student loan instead of paying the minimum and investing the rest:

It’s not a perfect model, but I think it will help visualize how different scenarios will pay off (or not pay off).

You can download the spreadsheet here and plug the numbers however you want to try different scenarios.

The conclusion we can take from this is that it’s hard to deny the fact that paying the minimum on your loans and throwing anything extra into the stock market is clearly superior to paying down loans faster than you are required to.

Click here to download the Student Loan Payment Analysis Tool

If you have student loans, do you pay the minimum or more than the minimum? Do you factor in relative market return if you pay more than the minimum or is it an emotional/psychological reason? If you don’t have student loans, would you apply this theory to some other debt you have such as a mortgage?

Final Note: Before a bunch of people comment that it’s better to not take out student loans in the first place, realize that 99.9% of people who will read this post are no longer in school and either have student debt or don’t have student debt. It’s not productive – at least not in this forum – the merits of going into debt to fund college or not going into debt to fund a college.

____________

Photo by Jeff Hart

You are so right about it being an emotional decision. It’s kind of funny – I am completely fine with not paying off a mortgage early, but have trouble applying the same logic to student loans. it’s exactly the same though. The numbers work. But…. I still think I’ll pay mine off early and lose a little bit of money for peace of mind.. Each time I make a payment I’m reminded of the not so great choices I made with my student loans.

We paid the minimum on our loans for a while then got really sick of the payments. IMO, paying a minimum payment on something for 10-15 years is demoralizing unless I can live in it =)

If you pay your loans off fast (say under 5 years), the 8% annual return isn’t as big of a deal since that average is over a long-term period. You could just as easily begin investing during a down turn and not get that return right away, which can throw the short-term calculation on which is better off. Of course, you could start the investing during a great bull market and have a better than expected return in the amount of time it would take you to pay off your loans.

I personally do a hybrid method. I do not throw everything we have at our student loans but I do pay them down aggressively. We then invest the remaining amount in the market. If my interest rates were lower (Currently at 6.55%) I could justify paying the loans off slower, but at this point, I would rather have the financial flexibility of not have a loan payment every month.

Very cool tool here DC! Nice work. While the idea makes mathmatical sense, we’ve chosen to aggresively pay off our student loan debt. There’s something about the psychological weight of debt that is impossible for me to “strip out”. I guess we each have to do what we feel is best.

Thankfully, I never had to deal with student loans, but I think I’d want them gone ASAP. Even though the numbers might say otherwise. Like you said, it’s emotional.

I get what you’re saying here. For me, my loans are between 8-8.5% interest, and I’m not sure I’m going to stay in the job I’m at now. So, with my income likely to fluctuate and my interest so high, I just feel like I have to pay more now. I also am a big believer that you should do with your money that which makes you feel most powerful. And I know for me, having $160k in student loans makes me feel the opposite of powerful. By paying A LOT more on them every month than the minimum, I’m able to pay them down quicker and feel so much better about my money situation. I think this is a great post that explains how paying the minimum might be a good idea for some people. I definitely think it depends on the individual situation.

I’m paying mine off ASAP. I appreciate the principal of this, but this assumes that servicing debt and investing are the only options. For shorter term obligations/goals, investing may not be a good idea. I have several things I need my money to do for me in the next few years. Having it tied up in a growth investment account does me no good.

I think a hybrid approach could be the most successful. You are tackling both the emotional and mathematical sides of the equation.

We paid the minimum on our student loans for years, and I honestly regret it. The maximum interest rate on them is 5.5%, so although the math theoretically might work out, we weren’t investing the difference. Now we’re trying to get rid of them in favor of having fewer monthly payments and trying to achieve more financial independence that way.

I do like your spreadsheet, which plays to my rational, number-crunching, side! I think it might work for people with lower student loan balances, who are not as concerned with lowering their monthly obligations.

You may want to plug in the tax savings factor in spreadsheet 2.0 — some families get a tax deduction on student loan interest; and if invested, the returns are taxable.

I actually advise clients to just pay the minimums and build up their wealth instead. Once the wealth is built to a point of comfort, then they can start to pay more toward student loans. The problem with student loan debt, unlike other forms of debt, is that once you pay it off, you do not have the ability to re-borrow. The money that you use to pay it down, is gone and heaven forbid you have an emergency or a life event like a wedding, child or home purchase and you need the cash to fund it. You may not have it because of the student loan repayments.

My remaining student loans have interest rates below 4% so it’s a no brainer for me not to pay extra. Although I admit sometimes I think about paying some of them off just so it’s done. It’s psychological I think. I did, however, payoff my loans that were at an interest rate of 6.8% even though I may have been better off investing it based on your spreadsheet. I think for those you follow the approach of paying the minimums have to have the discipline to actually invest the money that they would other wise have used to pay off the debt.

I would agree with your theory unless you consolidate into a much longer loan term, which I think lots of people do, self included. Also, it would mean people actually had to invest the money not going to loan payments, which I think lots of people don’t, also self included. It would also assume student loans are fixed rate, and not private loans.

I agree with you on this one. I have student loan with an interest rate of 1.7%. For now I’m not concerned with paying it off quickly. It makes more sense for me to pay off other debt, save for an emergency fund and build wealth than pay off this low interest loan.

I definitely see your point here, and I think that this could be a good option for some. Personally, I got to a point where I couldn’t wait to unload my student loan debt. After years of paying the minimum, it started to feel like a stupid monkey on my back that I just wanted off. My reasons were clearly emotional and psychological, but that final payoff felt amazing.

This is definitely a hard one because it’s so personal. As you said, in many instances you are probably better off paying minimums and investing instead. Psychologically that can be really difficult for some people because they just that BIG number staring back at them. But I think your exercise has great merit because we should do what’s best for our goals and creating wealth is a priority for most people. So look at it from all angles and suddenly seeing your student loans slowly and consistently decrease may be acceptable when you see your investments consistently growing. And some people will still not be comfortable with that scenario, but then they know throwing as much money as possible to eliminate their student debt is right for them.

I finally have let up a little bit and am trying to find financial balance. Meaning every month I add to retirement, savings, etc. Not just student loans. I feel so much better this way. Even though I would be a lot richer if I wasn’t so serious about paying my loans, I NEED them gone. It’s an intense burning desire. I honestly wish I could sit back and chill, but I just CAN’T!

If you earn less than 60k you can write the interest off which effectively lowers your student loan rate. I agree with this post as long as that rates are 5 percent or less. Some private loans are higher than 6 percent, at that rate it makes more sense to pay down your student loans.

If you’re working in a loan forgiveness program for public workers like teachers and lawyers you should pay the minimum. My friend is a public defender with 150k in loans with some at 7 percent in two years they’ll all be forgiven. In that timeframe he bought a house and maxed out all his retirement accounts, so he’s far ahead

Awesome tool here DC, completely agree that it is all about making sure you do the math and not focus on the psychology :)

I agree with your point. I like that you used the 8% since writing that article about the stock market return. Basically, I think it depends on your goals. Building wealth is the most important thing to me, so if I had student loans, I would be paying the minimum and investing like crazy. For many people, financial freedom is the goal. If that is the goal, then the most important thing is to pay off every single bit of debt so that you’re no longer in bondage to anyone. Mathematically and from my perspective, I agree with this article. Good read!

Holly at ClubThrifty Perhaps something like this spreadsheet can keep people’s morale up ;) You are “making” money if you can stick to the minimum payments.

The Barefoot Budgeter Thanks for sharing your thoughts! The emotions behind student loans are interesting. Student loans can pay off in dividends when you factor in a higher salary, while a real estate investment likely won’t give you that kind of ROI over the life of the asset.

Thias @WealthHike I hear you on the short-term point, but you hypothetically could have taken 10 years instead of 5, and I’m not sure if you looked at the scenario analysis in the file but you’d still be losing money because of the opportunity cost of leveraging debt over 10 years instead of 5. I’d get deeper into theory but I have 20 other comments to reply to ;)

BudgetforMore It’s interesting just how much psychology comes into play in personal finances. This isn’t the only scenario where people – even when presented with the math – chose to take a different approach because the psychological benefits outweigh the financial.

brokeandbeau It’s interesting how many people agree with you and go that route even when presented with the math that shows they are losing money by taking that approach. The way I see it you already have the debt, so why not leverage it to your advantage?

theFinancegirl I’m concerned with the theory that you should do with your money what makes you feel most powerful, mainly because of the sheer # of people who would gamble or spend money on expensive things they can’t afford because they feel powerful doing it! But yes, for some people that approach would work.

If you are at 8-8.5% it’s a different conversation. At that point the psychological benefits only have to SLIGHTLY outweigh the financial gain (if there is any) of not paying them off faster.

DebtRoundUp I think it totally depends on the person. For someone like me, a hybrid approach doesn’t work because I’d feel terrible going against what I know to be true from a mathematical and economic standpoint. I can’t fault people for taking the approach they take as long as they are willing to admit it’s a psychological/emotional choice when they go against the math.

GoodnightDebt If money is so tight that you can’t put additional money into investments I would argue it makes no financial sense to pay more than the minimum on student loans. In fact, it makes even more sense to NOT pay more than the minimum since having those funds available are so important to you in the short-term.

StaplerConfessions Oh great point about the tax deduction! The spreadsheet got pretty advanced as it is so I decided against complicating it further. I do want to layer in tax considerations eventually, though, especially if I make a file that caters specifically to mortgages.

blonde_finance Great point, Shannon. I didn’t even bring up the fact that you should make sure you have a full emergency fund before even considering paying down the minimum. Great point about not being able to “re-borrow” the funds. It’s something I should really think about when it comes to my wife’s masters degree. Instead of paying for it in cash, there may be a low-interest loan we can get. I could put the cash I would have paid for the class in an investment account. I’d just have to make sure I’m actually putting the money aside!

Andrew LivingRichCheaply I agree, it does take discipline to follow this approach. It also assumes you have the luxury of having the choice to pay more than the minimum – which would mean you already built up emergency savings.

Eyesonthedollar Good points, Kim. I’m sure you can understand the fact that to make a model for a blog post I had to layer in enough assumptions to make it worthy of posting, but not so many that building the model becomes a second full-time job ;) Though I do think it would be fun/beneficial to layer in additional scenarios that are a bit more complicated but also are similar to what people experience in real life.

Practical Cents Holy cow, 1.7% is the lowest I’ve heard of so far. That’s incredible! There really is no reason to EVER pay more than the minimum on that loan.

TheWriteBudget I can’t fault people for paying off more than the minimum, especially if they are willing to admit that it was psychological/emotional in nature. Congrats on having your loans paid off!

ShannonRyan I think this comes down to financial literacy as well. Are we pushing for people to think more emotionally/psychologically about money or are we pushing them to learn (and put in practice) principles like leveraging debt? The more comments I read the more I am thinking about that very question.

deardebt That’s really interesting and you definitely are not alone. I’m starting to think the field of “financial psychology” would be really interesting to study. It plays a bigger role in our finances than we think.

Charles@gettingarichlife Your friend is very smart, and that’s definitely something I’ve thought about. Do you know if that forgiveness program applies to nonprofit workers as well? I thought it did for some reason.

We can split hairs about the 6% rate, but you’re right that the higher your interest gets the more limited your gain will be.

mycareercrusade Thanks for the kind words! I spent a decent amount of time creating the tool so I’m glad you found it useful. What’s interesting is I’m finding a lot of people who comment on here are advocating for the psychological approach instead of the mathematical one.

MoneyMiniBlog Thanks for the kind words and for sharing your thoughts. The financial freedom thing is interesting to me. If I had zero debt but no savings or investments I wouldn’t feel nearly as free as if I had 50k of debts but 100k of savings and investments. I guess I’m used to looking at numbers on paper. If one cancels the other out I’m able to take the psychological aspect out of it and be happy about my net worth.

I’ve thought about this topic repeatedly. I wrote about something I did with stocks with the plan to use the proceeds to pay off my student loan. I’m for paying off debt as soon as possible, I just can’t possibly think about having a student loan when I’m 40, the thought actually makes me a little sick.

I think it depends on your time horizon, I have a plan to pay off my remaining student loans in 9 months, so investing doesn’t make much sense, but would 2 years or 10 years make a difference, I think it could.

http://www.evenstevenmoney.com/buying-stock-to-pay-off-debt-mistakes-ive-made-or-im-a-genius/

I was just talking to blonde_finance about this with our situation. Over the $300k mark now…. I just hate that if we pay the minimums on it which will be 3k+ a month, we will pay 300k+ in interest over the course of those years, which is two college tuitions for the twins or a bunch of other things. I just can’t deal!!

EvenStevenMoney Paying off your loans quickly does NOT change the time horizon. I even set up a scenario in the spreadsheet to show that point. The reason it doesn’t change the time horizon is because you are still sacrificing 10 years of gains by paying it off early.

BudgetBlonde blonde_finance It definitely can come down to psychology, especially when we are talking big numbers. I can’t blame you for wanting to get that lump sum figure lower.

That makes sense, but you’re completely taking out the emotional aspect of it–and we’re dealing with humans, not calculators, which is where your logic falters : )

We paid off our $45k debt in 45 months ($32k of which was student loans). We saved on the side too, and were able to invest through a 401k, but no matter how much we were putting away, it sucked having those extra payments every month going to toward something I had achieved 8 years ago. We’re saving like crazy now and doing much better than when we were in debt.

NewlywedsBudget I actually factored that into the assumptions -> “3) Just math, no psychology or emotion”

If you can take the emotional aspect out, though (as I feel I have), the numbers show that you are losing money if you pay them off faster than required.

Applies to non profits. My friend is a public defender for a non profit the city outsources to. I said 6 percent because a balanced portfolio of 70 percent stocks and 30 percent bonds should yield that. Being all in for stocks often make people nervous, although I don’t follow my own advice

Very intriguing post DC. I find the psychological aspect interesting as well. For me the most emotional comfort comes from knowing I am getting the highest return.

I’m curious how you’d look at this when saving for a house in the next year or two? Too short-term to invest in the stock market, so is one better off keeping it in a savings account and building toward the down payment? Do you happen to know if the amount of your student loans affects the rate you can get on a mortgage?

DC @ Young Adult Money I see what you are saying, regardless if I put 20K over 9 months or 20K over 9 years there is still a difference since it matters more that you are investing rather than paying off debt.

I’m still opting for paying off my debt early for me it goes back to asking myself would you be ok with being 40 and having a student loan? Also I believe the greatest way to build wealth is to have no debt, if I don’t believe that I would crumble to the ground.

bartbartels Thanks for stopping by Bart! I also feel the most emotional comfort knowing I’m getting the highest return possible.

The logic definitely applies to people who have a mortgage at a lower interest rate (lower than 8%, at least). As far as saving for a down payment, I’m not sure.

I know the student loans come into play when buying a house because they are brought into the debt to income ratio calculation. With that being said, you only get a benefit if the loan is COMPLETELY paid off, since paying off extra doesn’t actually lower your monthly payment.

This makes sense and my husband and I want to switch to this. However, our concern is that our minimum monthly payments together are almost $1100 which is a concern if we find ourselves unemployed and affects the type of place we can live and the kind of jobs we can accept. If we finish paying them off in 3 years as is our current plan we then don’t have to worry about being stuck with a payment we can’t afford should something happen.

DC @ Young Adult Money mycareercrusade it usually is all about the psychological side of it as most people (probably sometimes including me) think about money using emotion rather than cold hard numbers

emu361 You shouldn’t have to worry that much. Just build up emergency savings to cover a certain number of months and invest the rest. If you became unemployed you could use the emergency savings to cover it, and if you really get in a bind you could start withdrawing some of your investments.

The math will pretty much always work out for items like this or Mortgage’s to invest rather than pay interest. I think the difference is the risk of the return, paying off your debt is a guaranteed rate, while the stock market is not. When the PE ratios (current shiller PE is 25.82, where the median and mean are basically between 16 and 16.5) are this high will the stock market returns actually exceed 6% of 10 years? Maybe, maybe not. So my plan is to do both invest and accelerate debt pay off. If stocks get to be more reasonably price, or at least around average prices, then the math works out in their favor. Not sure if it does in an expensive stock market.

Interesting! I’ve only ever paid the minimum towards my student loan because that’s all I can afford. I’m able to apply for repayment assistance, and get my monthly payment lowered. I need to look into it further, but I know that I will soon be eligible to reach the next level of repayment assistance which will help pay down my principle faster.

DC @ Young Adult Money EvenStevenMoney I was looking over the spreadsheet and it looks great, I was wondering after you pay off your student loan shouldn’t that total be added on to your investment amount contribution? ie $100 payment and $200 additional payment, when you pay it off it should be an investment of $300.

mylifeiguess Lower principle is always good! This post is definitely for the people out there who have the option to pay down more than the minimum – many people don’t.

FranklyFrugalFI Fair enough, but I’d encourage you to leave a comment on the post about interest rates instead. For this to work I’m assuming that people agree with an average market return. I don’t think most people have enough knowledge or reason not to. Otherwise you get into the whole “timing the market” debate which I think we’ve seen 99% of people should avoid.

DC @ Young Adult Money FranklyFrugalFI That is true that you shouldn’t try to time the market, and over the long term stocks are the better pack off. But the default length of student loans is 10 years, so you have to question what is the best investment 10 years from today? You don’t know that answer until 10 years from now of course! Which is why I decide to do some of both, pay extra on debt and invest.

DC @ Young Adult Money FranklyFrugalFI On a side note, I did recently get some AT&T instead of paying off extra debt, the yield is so high that it matches my mortgage debt (probably the same with student loan debt). Even without dividend growth this investment can pay the extra interest on the loans plus a little over the 10 year time frame… crazy!

I definitely should have done this because I had a very low loan rate (something like 2.685?) and I could have had quite a bit more in my retirement accounts. Still glad to have that debt paid off early, and now I can focus completely on investing, not debt.

Clearly it makes sense to pay off your larger interest loans first. And if you can get a better rate of interest on savings and investments than the interest rate on your student loans, you’ll gain by investing. But whilst that argument is mathematically sound, it doesn’t address human nature: our money-savvy friends here in the PF community are all looking for ways to earn more and spend less so we’re all on the same wavelength, but what about Joe Public? I think he’s unlikely to have the discipline necessary to take his extra cash and fill up on dividend stocks or max out his pension contributions. We want shiny stuff. And we’re weak.

Myles Money Yes, and I mention in the post that this does not factor in human nature. Human nature is not always logical and many times is based on emotions even if they conflict with logic.

What scares me the most is the fact that student loans can’t be bankrupted like CC’s, car loans, mortgages, or medical bills, and all of mine have fairly high interest rates. All are only 1-2% lower than what would be my returns (hopefully) in the stock market. For me, I’m glad to let psychology take over…the feeling of security by paying off 60k in debt that can’t go away no matter what is far better than any amount I could accumulate in the stock market while paying them off. In a way it’s like spending that 1-2% (~ minus the tax deduction, so an even smaller % really) for a lot of financial security in case something goes awry.

I still put money aside in an e-fund, am ahead on all of my loans so I can take a break for a few months paying them if needed, and invest some money in stocks, but also still quite a bit in my 401k and company stock. For me, I try to balance it all, but my student loans are still going to be my very top priority for security’s sake.

Now when my low-interest car loan is all that’s left, psychologically I’ll want to pay it off fast too for peace of mind, but holding onto that loan for longer feels better and it probably won’t be my top priority — investing and building wealth will precede it.