You have thousands of dollars of debt. You have thousands of dollars in your 401k.

I think you know where I’m going with this.

The questions is: Should you ever cash out your 401k to pay off debt?

If you’re wondering the answer to that question you’ll be happy to hear that I have created a simple calculator that will tell you when it makes financial sense – and when it doesn’t make financial sense – to cash out your 401k to pay off debt.

The 401k debt pay-off cost-benefit analysis tool

When a reader asked this question I couldn’t help but try to find a way to break it down to a simple mathematical formula. After all, we are talking about interest rates and future values, which are easy to input for cost-benefit analysis.

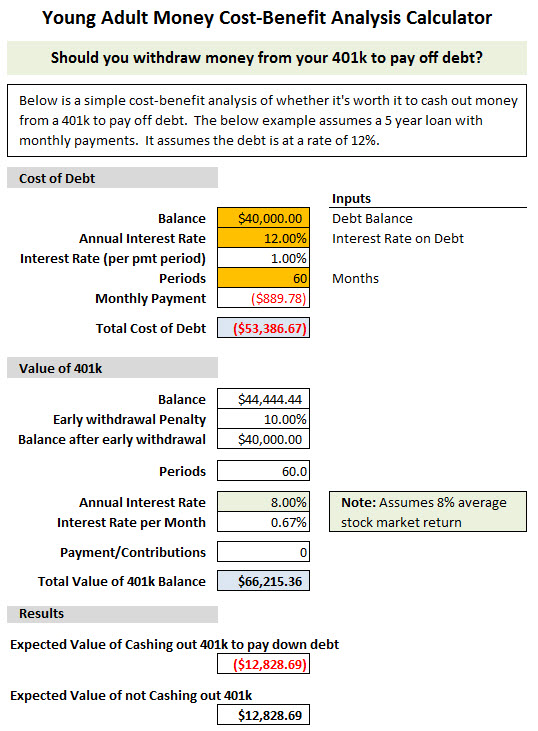

I created a tool in Excel that tells you whether it makes financial sense to cash out your 401k to pay off debt. Below is a picture of what the tool looks like in Excel:

The only inputs that are needed are the number of months left on the loan, the interest rate on the loan, and finally the amount left to pay on the loan (in months).

As you can see in the above example, it does not make sense to take money out of your 401k to pay off $40,000 of debt at a 12% interest rate (5 years left on the loan/debt). Withdrawing money from your 401k would actually end up being a net loss of approximately $12,829. Continuing to make the payments on the loan and keeping your money in your 401k gives you a relative gain of approximately $12,829.

Again, this calculation can be run on any debt. Simply plug in the amount left on the loan, the interest rate on the debt, and the number of months left on the loan. Everything else is automatically calculated.

Assumptions

As with any financial calculator/model/tool, there are assumptions. A couple of the assumptions built into this tool are:

- Average market return – I used 8% as the average market return. I have seen people use as high as 10%, but I think it’s better to be on the conservative side. Some will argue that it should be higher or lower. That debate is for a different post.

If you disagree with the market return used in this tool, simply change it to whatever you think the return should be. Just realize that it’s extremely difficult to predict what the market will return in the future and I personally advise keeping it simple and going with 8%.

- You have enough in your 401k to pay off your loan – You may have noticed there is no place to input how much is in your 401k. Instead the amount is automatically calculated as the loan amount divided by .9 to factor in the 10% penalty for early withdrawal.

Takeaways

The main thing I took away from creating and testing this tool is that unless you have a very high interest rate it is rarely worth cashing out your 401k to pay off debt. There are some scenarios, though, where it is worth it. If your interest rate is over 20% you may be in a position where cashing out your 401k is +EV.

I hope you find this tool useful – if not fun – to see how cashing out your 401k to pay off debt can be put into a positive or negative expected value.

Click to download your own copy of the Excel 401k Cash-Out Cost-Benefit Analysis Tool

Have you ever considered taking out of your 401k to pay off debt? Do you know anyone who has done it?

I’ve definitely fantasized about cashing out just so I could pay off my student loans but I won’t do that though. The 10% penalty is pretty bad and not to mention that if you do cash out your 401(k) the withdrawal also becomes taxable income to you. Both Federal and state (if you live in a state with an income tax). I know there are a few exceptions.

I agree that it is probably not a good idea for most people at all. The problem is that by paying off the debt with retirement, you don’t learn anything about how you got into the debt in the first place, so you’re much more likely to be back in the same position (with a lot of debt). You also end up paying a lot in penalties, losing money (compared to if you didn’t touch it until retirement). Retirement should be left alone, in my opinion.

I know several people who have cashed out their 401 for different reasons. Believe it or not, people did it to pay for funerals all the time when I worked at the funeral home. It always seems like a bad idea to me =/

It looks like a great tool DC! I spoke to investors all the time in my old job that did take out money from their 401ks and nearly every time they regretted it. It was usually because they simply did not pay it back in and realized what they had done. I think you have to take it on a case by case basis, but I generally would advise against it in most cases.

BudgetforMore Good point about the Federal and local income tax on the withdrawal. I did not include it in this model because it varies so much state-by-state. I think it’s safe to say, though, that it only makes sense to cash it out in a dire situation or if the debt is at an extremely high interest rate and you are unable to refinance to a lower rate or do a zero-balance transfer.

theFinancegirl Yes, there are many arguments against it and other things to take into consideration. Unless it’s a dire circumstance it really is best to leave it in your account.

Holly at ClubThrifty I can definitely see why people would do it for funerals, regardless of how wise it is. There is too much to gain by keeping it in your 401k, in my opinion, and far too many penalties that come when you withdraw funds to make it pay off from a financial standpoint.

FrugalRules Thanks John! I think the tool/spreadsheet really illustrates how

much you lose when you take out money from a 401k to pay down debt. I absolutely agree with you about the case-by-case basis. Every situation is different and I could list off a number of scenarios where I would advise others – myself included – to withdraw some funds from a 401k.

Nice work DC! Simple calculations can really show you some eye opening things.

Looks like a great tool! My first reaction before even seeing it was no no no. I’m glad the tool proved I was correct. ;-)

You know I LOVE when you share your calculators and this is a great one! John recently wrote about how many people are taking money out of 401ks and this is a great check before making that decision. As I wrote a while back, it is important to really think about your money BEFORE you put it in the 401k because it is not easy or cheap to take it out.

That’s a great calculator, and I agree that there would be very few situations where cashing in a 401k is a good idea. Most people I’ve know who have done this used the money to buy a house. In the end, I think that’s likely a bad idea as well. Maybe if it was an investment property that would give you a monthly cash flow forever, but not a house to live in. I’ve always viewed 401k or IRA money as untouchable, like it was spendtmoney that I’ll never get back. Thinking of it as money you can pull out if you need how you should view it at all.

DebtRoundUp Thanks Grayson! I’m a numbers guy so I like to see what story they tell. I think this would be a valuable tool for anyone considering taking out money from their 401k to pay down debt, even high interest rate debt.

debt debs Thanks! I think that many have considered this to give them a “clean slate,” but really if you can get past the psychological benefit of having $0 in debt it’s better to leave your 401k alone!

Awesome calculator! These kind of simple steps can help someone open their eyes and find what is right for their financial situation. Thanks for sharing!

I’m sure many people will find this calculator very useful. I personally don’t plan on taking money from my 401k. I just don’t want to touch that money. My current debt is manageable and I’ve been able to find other ways to pay it off.

This is so useful! I’ll have to share that on the FeeHacks blog too, as I’m sure a ton of people consider making this move.

blonde_finance Great point about thinking about the money before you put it in a 401k. I think a lot of times people feel the pressure to put in more and more, but if you are just going to withdraw it later on (with penalties) it may have been better to not deposit it at all.

Eyesonthedollar Hmm the housing question brings up new variables, such as how much money you lose by renting versus owning and whether the gains made in your 401k are higher than the loss incurred from renting. It would be a more complicated calculation but I think it can be done.

Quizzle Thanks and no problem! If we’re talking about a financial question the first thing that should be done is plugging the numbers in a financial calculator. I’m surprised more people don’t take that initial first step.

Raquel@Practical Cents I have a bit of an unconventional view of debt paydown and I typically don’t see any reason to rush to pay off debt unless it’s high interest debt. I think people would benefit more by investing it in the stock market where historically gains have been > 9%.

Molly at FeeX Thanks Molly! Definitely feel free to share the tool!

Wow, pretty useful calculator DC. The only debt I have at the moment is student loan debt so I won’t take out a loan to pay it. I would consider taking a loan to help with a home purchase…since housing is so expensive in NYC, sometimes it seems it is a necessity. I might be able to avoid it though. But I might still take a loan to invest in a rental. We’ll see.

Love the calculator DC! Only in a severe emergency (like maybe avoiding a bankruptcy) would I take money from a retirement plan. If you do want to accelerate debt payoff the prudent step would be to temporarily stop contributing to the 401(k). Put that money towards the debt and then pick up contributions again when the debt is gone.

Hey DC, I don’t have a 401K, but I do understand debt and investing. The only debt I would imagine cashing out a 401k for would be credit card debt. As you said, it would definitely have to have a killer interest rate to be worth it though.

Great calculator, DC. Generally speaking, it is very rare that cashing out your 401k to pay off debt is your best solution. Depending on the situation, you may be able to completely eliminate your debt in one swoop, which feels very good in the moment, but unless you have other retirement accounts, you have no money saved for your retirement. People tend to think in the moment and your calculator let’s them see the bigger picture. A win today but it could mean a significant loss for your retirement, needing to work longer than planned and save larger amounts.

I have never come close to having to do that thankfully, but I do know people that have cashed out their 401k just to live, and that breaks my heart.

Andrew LivingRichCheaply Debt can be a very useful tool for building wealth, when used properly.

Brian @ Luke1428 I have a similar view as you on this. Unless you are avoiding catastrophe, like bankruptcy, there isn’t much reason to cash anything out of a 401k. I actually wouldn’t advocate stopping 401k contributions to pay down debt unless it’s greater than 8% interest rate. There really is no reason to pay it down fast in that case.

DC @ Young Adult Money Raquel@Practical Cents I have to agree with you on this one. I have a bit of student loan debt but at 1.7% interest I don’t see a need to rush the payoff right now and it’s definitely not worth taking money out of a 401k in my case. I think your tool will help many people see that it rarely payoffs to borrow from a 401k.

Joshua Rodriguez Yeah there really is no incentive to cash it out unless it’s for debt with a VERY high interest rate. I also think Brian brought up a good point with the severe emergency scenario. I think I would cash it out in that case as well.

ShannonRyan I think we are on the same page, Shannon! Each financial decision – at least each BIG financial decision – should be analyzed from a numbers standpoint. There will always be an emotional and psychological influence but overall it shouldn’t be weighed nearly as much as the financial “facts” of the situation.

Beachbudget If you reach a “disaster” scenario where you literally might lose a home/condo or something you depend on, it might make sense to just pull the trigger and alleviate the scenario. Generally it’s not a good idea, as I think most people agree.

Raquel@Practical Cents DC @ Young Adult Money I hope a lot of people see the tool! I also would not be in ANY rush to pay off your student loans! I would pay the minimum every month and not a penny more. That’s just me, though.

David

Nice calculator but what about taxes. A 44 k balance at a 25 percent tax rate with the penalty will leave you with 29 k.

I’m in the camp of you should never cash out your 401k as that is protected from creditors. High interest debt is usually unsecured debt and can be discharged in bankruptcy.

Charles@gettingarichlife That’s definitely something to factor in. It varies by state and income so I left it out for simplicity’s sake, but the fact is even without the taxes your debt would have to be a VERY high interest rate to justify withdrawing.

Nice calculator! I think it will help for quick reference. Nevertheless, I personally wouldn’t take out money from my retirement account, since the longer you keep it the more compound interest you can get. I think this would be my very last resort if I were in this situation.

Great value add here DC, unfortunately being an Aussie I won’t be able to use this. Our superannuation, equivalent to the 401K is locked in until a certain age but have shared with my network and sure they’ll get value out of this :)

Cheers and good luck to the US on Thursday night, although I want to see Germany (as winner of the group) in the 1/4 for Rio ;)

So grateful to not have to make these kinds of tough decisions (at least not yet, and fingers crossed for ever).

PoorStudent I’m on the same page as you. I like to run numbers on stuff like this versus make emotional decisions. I would only withdraw under an “emergency” scenario, which would include high interest debt and no access to other capital.

mycareercrusade What why would you want Germany to be winner of the group?!? USA! USA! USA! :P

I’m glad you liked the tool and I have actually read up a decent amount on superannuation so I know a little bit about it. I appreciate you sharing it with your network, though!

brokeandbeau Definitely not a good place to be in, but some people REALLY like the idea of wiping out their debt. If they can just keep making consistent payments, though, they likely will almost always be better off keeping their money in their 401k instead.