There has been a lot of discussion on the blogosphere the past few months about financial literacy. Whether it’s been defining what financial literacy means to each blogger, how to best increase financial literacy, or what sort of time commitment should be given towards financial literacy, there have been countless blogs weighing in on how to address this issue.

Today I want to share about a company whose mission is to increase the financial literacy in young adults. Financial Education of America created Futurebuck, a web-based educational program that teaches young adults financial literacy. “Young Adults” can be an ambiguous term, but Futurebuck’s target demographic is 18 to 24 year-olds, students in particular.

Futurebuck – An Overview

As I mentioned, Futurebuck is a web-based educational program. It is not a free program and currently is on sale for $39.95 for a six month subscription.

The Futurebuck program has ten different modules, covering topics from credit cards, student loans, insurance, and more.

Each module has one or two video segments that cover the specifics of the topic.

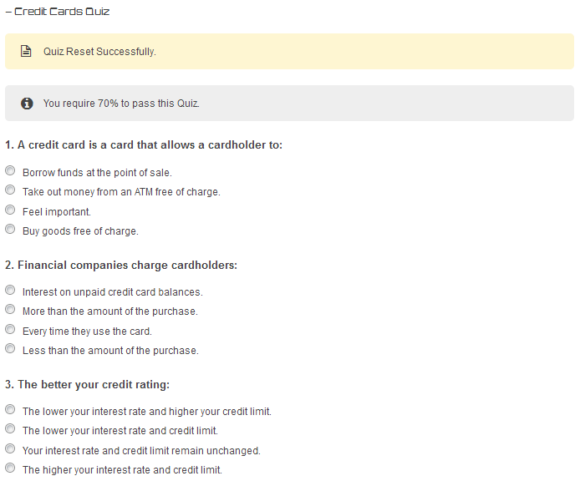

At the end of each segment there is a ten question quiz. In order to pass the quiz, you must score 70% or higher. Below is a few sample questions from the credit card module:

Completing the Futurebuck course is fairly straightforward: you go through each of the ten Futurebuck segments and take the quiz until you get a passing score. Futurebuck has additional resources as well, such as their blog and library of additional resources. I found the library to be much more useful, mainly because the blog does not seem to be updated regularly (the last post was from two months ago). The library, on the other hand, had a variety of links to useful external resources.

Thoughts and Reaction on the Futurebuck Course

When I went through the Futurebuck course, I honestly would have liked more information for the $39.95 required fee. While they did give a great overview of the ten topics the program focuses on, I would have liked to see more written articles and content for each topic instead of just the two-segment video options. I hope that in the future they consider adding additional written content and modules.

As I’m a big advocate of people learning personal finance earlier rather than later, I think Futurebuck is a great options for schools to integrate into their coursework. For example, I think this would be very beneficial for high school seniors or college freshmen, since they would have time to directly apply it to their financial choices in college as opposed to looking back and wishing they had gone through the course earlier. It would be fairly easy, with the modules and quizzes, to require students to go through the course either during a particular class or on their own from home.

Unlike blogs and other sources of personal finance information and advice, Futurebuck is a structured program that doesn’t cover random finance and lifestyle topics, but instead gives an educational overview of ten topics they deem important to 18-24 year-olds. I’m not saying that blogs couldn’t provide the same information (I am, after all, a blog owner!) but I certainly see it as a different sort of purpose than what personal finance blogs serve.

All in all, I think that Futurebuck could be a great introductory course for students and can certainly arm them with some good information that may help avoid some of the costly “learn as you go” experiences that most college students and recent grads have faced. With the rising cost of college education, a constantly changing economic climate, and more demands on young adults than ever before, it’s become extremely important that financial literacy be made a priority.

Do you think courses like Futurebuck should be offered/required at more high schools and colleges? Are there other topics that you think should be added as additional Futurebuck modules?

______________________________

Full Disclosure: I was compensated for this review, but the opinions are my own.

I don’t know about this product specifically, but I think teaching basic personal finance in schools is absolutely a good idea. Based on my extremely limited and unscientific review of the questions above on credit cards though, I’m guessing you could compile a bunch of links for free that would teach the same information.

Matt @ Mom and Dad Money I almost didn’t post those questions because they really aren’t an accurate example. I would say the whole point of integrating the quiz is so that schools that require students go through Futurebuck actually go through the modules, similar to how work training sometimes have what seem to be extremely easy questions coupled with some tough ones that you wouldn’t know if you didn’t actually go through the training.

I think an 18-24 year old would be crazy to drop a cent on this. There are just WAY to many free resources and blogs available that can teach you this stuff and probably do it better in many ways.

As far as educating high school students, absolutely. I would have loved a class that taught about financial responsibility and the pitfalls therein, and it seems this program could be nicely integrated.

KyleJames1 It seems as though what they are really going for is to get their program into a structured environment like schools. I think they’d do well to market it to high school administrators.

From what I can see here, I do agree with you that these types of courses would be better suited for high school students and freshmen in college. I personally wouldn’t pay for something like this, but if the schools purchased licenses and the students were able to use it for free as part of a broader finance curriculum at school, I think it would be a decent supplement. I don’t think many high school students are going out on their own and looking for free resources on these topics anyway, so something is better than nothing.

JourneytoSaving I think licenses are what they should really focus on as well, and it seems to be their approach as they say “student” quite a bit on their website when explaining the program, and you even sign in as a student of whatever school you attend.

It sounds like it would be a valuable tool to help teach people but it does seem like they provide a brief summary of the information. The $40 cost seems a bit steep for a brief sessions that you are provided. Plus, with the nature of this information, it seems like a donation based scheme would be more appropriate. I will teach you everything you need to know about money, but only if you pay me.

MicrosMissions Honestly I think the strategy they should (and probably are) taking is to market this to high school administrators to get it into required curriculum.

I’ve never heard of this program but it sounds like a great option to inform young adults! Thanks for sharing this. I think if it’s helpful, it should absolutely be available to high school and college students so we all learn how to deal with finances when we’re younger.

I think Futurebuck course is worth to pay! It would help the young ones to be more responsible for them to be a better person and for me it should be offered at schools specially in colleges.

This is interesting, I had no idea this kind of service was out there.. if it’s more of an overview or an introduction, I can see where we wouldn’t find it worth the $40 – after all, us PF bloggers already know quite a bit about money! :) But I think it would be an AWESOME thing to include in a high school or college course somewhere. I wish I had started learning about finances earlier, and it would certainly have been easier to acquire knowledge had it been integrated into my education instead of having to be researched and found out all on my own.

That does sound interesting. Anything for younger kids, like maybe juniors or seniors, to get them to understand finances is something I’d support.

It’s really important to build the foundation of financial understanding as early as possible. The cost of the courses aren’t expensive but for the vast majority of young adults it’s pricey. Pricey because they’d rather spend the $40 on a new shirt than a course they should do but often neglect.

I definitely think selling these courses to high schools, organizations and financial institutions is the best way to get these courses to teens and young adults. I’ve often champion the “required courses” before someone can open up a checking or credit card.