Home, auto, and student loans dominate the content on the internet, but in reality there are many more reasons for taking out loans. Prosper.com is a peer-to-peer lending site that makes it easy to take out a personal loan for consolidating credit card debt, paying for an expensive home repair, or starting a small business. Whatever the reason is, today I will show you how easy it is to take out a loan on Prosper.com.

Home, auto, and student loans dominate the content on the internet, but in reality there are many more reasons for taking out loans. Prosper.com is a peer-to-peer lending site that makes it easy to take out a personal loan for consolidating credit card debt, paying for an expensive home repair, or starting a small business. Whatever the reason is, today I will show you how easy it is to take out a loan on Prosper.com.

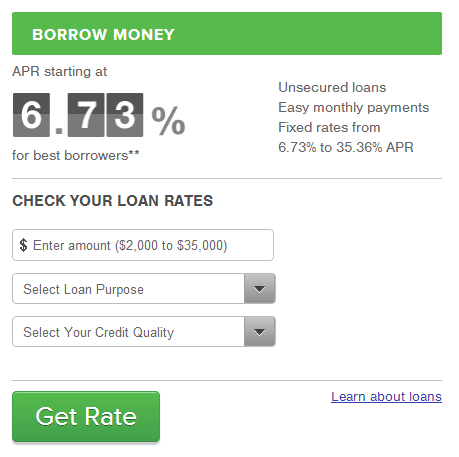

First go to the Prosper.com home page and scroll down to the Borrow Money section. Enter the amount you are looking to borrow (between $2,000 and $35,000), your loan purpose, and credit quality. If you don’t know your credit score go to Credit Sesame to see what your score is.

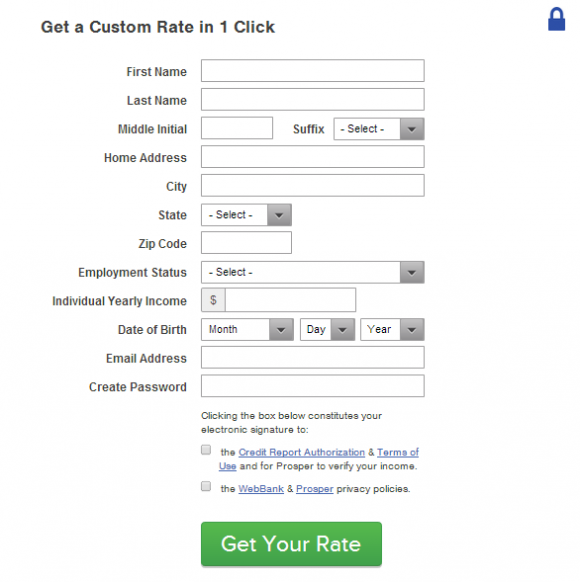

On the next screen, fill out the required information to get a rate for your loan. Per Prosper, checking your rate will not affect your credit score.

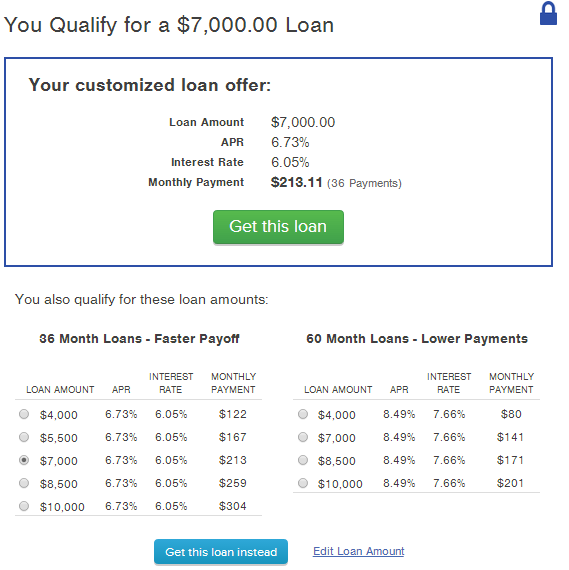

Within a few seconds, a preliminary rate will be quoted for you. Additionally, longer loan terms are offered at higher interest rates. Standard loans on Prosper are 36 months.

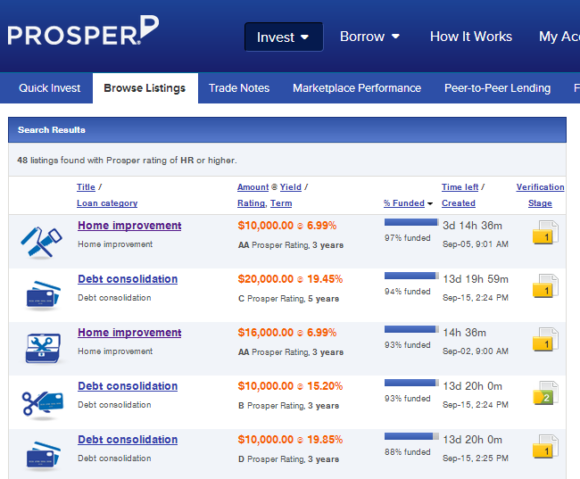

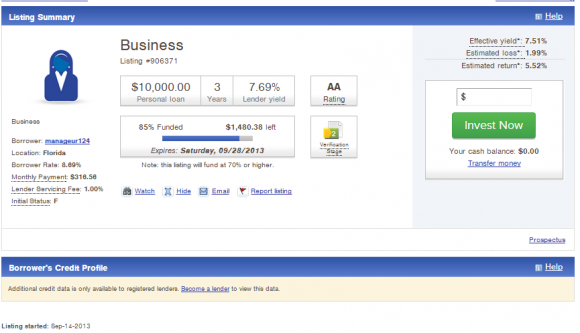

If you choose to, you can list your loan at this point. Your listing will then be put with the other listings and people looking to become lenders will have the option of funding yours. Below is an example of how listings are displayed for lenders.

Below is an example of a listing. Some loans get funded relatively quickly. This $10,000 business loan is already 85% funded one day after it was initially listed.

Prosper is just one of a number of options available for personal loans. I like the idea of peer-to-peer lending and know people who have had positive experiences with it both as lenders and as borrowers. If you need a personal loan, for whatever reason, I would encourage you to at go to Prosper and see what rate you get quoted.

One perk that I really like about Prosper’s site is that there is no pre-payment penalty. That means if you take out a personal loan because you are waiting on a large cash in-flow (such as an employee stock purchase that will not happen for a couple months) you can essentially pay off the loan two months later. This is a huge benefit because I would hate to be locked into a loan with a relatively high interest rate and be unable to pay it off early without incurring a penalty.

Taking out a loan shouldn’t be easy and it worries me how easy peer-to-peer lending is becoming. Its difficult to take out a loan for a reason!

moneystepper At the same time, getting a credit card is much much much easier than taking out a personal loan. Both are based off of your credit score, though, so it’s nice that there isn’t additional overhead from meeting with a loan officer and whatnot.

Cool breakdown DC! I’ve never used Prosper or anything like it. That said, I can definitely see the benefits of it if you’re wise with your money. I bet banks love competing with the fact you can get a loan from the convenience of your own home if you want. ;)

FrugalRules Banks seem to make the process overly difficult. I tried to meet with a personal loan officer and he was only available at my branch a few hours a week and only when I’m at work. Couldn’t do anything over email, either. Outdated model imo.

Sweet. I wish I could invest in Prosper or Lending Club. Maybe one of these days they’ll change the laws in my state.

Holly at ClubThrifty I did not know there were states that outlawed investing through p2p companies, very interesting. I know a few who have invested in it with good results.

What do you think are some of the situations in which someone should consider going this route? When do you think it’s likely to be a good financial decision?

Matt @ Mom and Dad Money Hey Matt I appreciate the question. I think each individual needs to answer that for themselves. As far as what my opinion is, that sounds like a question for another post : )

Come on DC, did you hack my blog or something and see this post in draft? ;) I had the same thing that I had partially written! Great job on this one. Now, I have to jump back in mine and change up a few things.

DebtRoundUp Haha unbelievable! But great minds think alike ; )

DC @ Young Adult Money That is true. Now, just let me know of a good post you are working on, so I can put mine out first! Sound fair?

DebtRoundUp Haha I’m sure it will happen sooner or later.

I wish I could do for even a small portion of med school loans but the rates aren’t much better.

BudgetBlonde Yeah if you had high rate student loans you could perform a little interest rate arbitrage by taking out one at a lower rate on here : )

On the other side of the equation, an early repayment can mess up your returns or so I have read, but better getting the money back than a default.

RFIndependence Yeah you have to re-invest the money sooner than you would have liked vs. having it locked in, but that’s just part of the deal. I think they get a lot more people to take out loans knowing they can repay early – I know I personally would prefer this option.

The early repayment can definitely be a mild annoyance from the investing end. I don’t get nearly as much of a return for the risk I took on. However, if given the choice between that and a default, I’ll take the early payoff every time. Low returns is better than no returns.

MicrosMissions This is a post about taking out a loan, not about the lending side of Prosper. Just kidding : P

I’m curious to see what happens with companies like Prosper over the long haul. My fear would be higher default rates because people would not take it as seriously as a bank loan. I guess that doesn’t affect the borrower too much though.

Eyesonthedollar Great point, Kim. They seem to have been working pretty well for a while now and I would hope people realize what a loan default does to their credit score!

This is interesting DC. I had heard of Prosper but really didn’t know how it worked. While I don’t need a loan, I would definitely consider loaning money to someone.