Being in good health is priceless, and staying in good health requires that you have access to health care. Nevertheless, there are millions in the United States who are not covered by health insurance. While I do not pretend to know every person’s financial and life situation, I hope by the end of this post that those who are not covered realize the value of health insurance and move forward with getting coverage.

Last weekend I helped my sister move to a new apartment. After finishing the move, the group of us who helped with the move went out to eat. While discussing various topics, health insurance came up. I found out that one of my sister’s friends did not have health insurance, and she didn’t seem overly concerned about not having it. After hearing another story of another young adult who is going without coverage, I felt the need to write a post that explains the benefits of health insurance and why everyone needs it. I see health insurance as an absolute necessity and a safeguard against unexpected expenses that can wreak havoc on our finances.

First off, the purpose of health insurance is to insure you against the risk of high medical bills. Every single person is carrying a potential risk of a high dollar medical bill. Many of these high dollar medical bills, or claims, are unexpected and/or unpredictable. Insurance companies are taking that risk away in exchange for monthly premiums and some cost-sharing on your part (but only up to a predetermined out of pocket maximum). They can take on the risk much better than any one person is able to (unless you are Bill Gates or Warren Buffet).

To show the benefits of health insurance, it can be useful to look at what things would have cost without insurance coverage. In the past year, these are the costs I would have been responsible for if I was not covered by an insurance policy:

- Appointment with a Family Practice Doctor (x2): $500

- Appointment with an Ear, Nose Throat Specialist or Pulmonologist: $450

- Septoplasty and Endoscopic Sinus Surgery: $22,000

Not counting prescriptions and a pre-surgery physical, I would have been on the hook for at least $22,700. Because I have health insurance coverage, I only had to pay my monthly premium plus $3,300. That’s a huge difference. Before 2012 started, I did not expect that I would have to go to a specialist or have surgery. I would have estimated that I would only have needed a few hundred dollars for checkups.

There is always a risk of an unexpected medical bill, and if it is a surgery or a hospital stay, you are easily talking thousands upon thousands of dollars.

Don’t let the lack of health insurance set you back financially. Medical claims can easily reach levels that drive people to bankruptcy. The good news: there are options available to you if you are not currently covered.

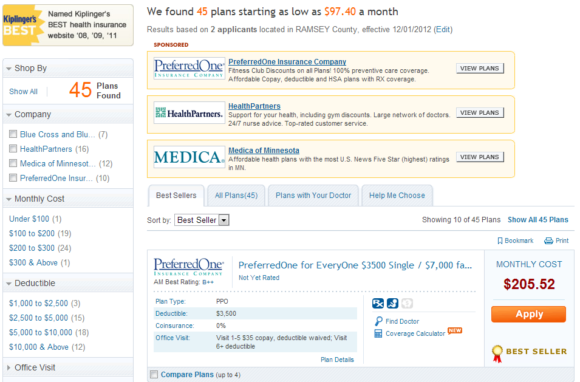

The easiest way to shop for coverage and enroll in health insurance is through eHealthInsurance, an online broker of insurance plans. eHealthInsurance has over 7,000 health insurance products from over 160 healthcare providers.

To view the plans available to you, first head on over to eHealthInsurance.com. Once you are there, choose the type of insurance you are looking for.

Next, plug in your information. If you have a family member that also needs coverage, include their information as well.

Click GO to view deals. There will be offers from various health insurers with various rates. Before you think the rates listed are too high, realize that this is to prevent something catastrophic that will leave you with hospital bills in the tens of thousands of dollars. Also realize that when health insurance exchanges open on January 1st, 2014, there should be more competitive rates available to those who are not offered health insurance through their employer. Until then, you will have to purchase through the private market if you want coverage, and eHealthInsurance is the best marketplace out there right now.

Plans will vary in deductibles, out of pocket maximums, and monthly premiums. Lower monthly premiums are not always better, since deductibles may be higher for these plans. A deductible is how much you owe before the insurance starts covering costs. Some high deductible HSA plans are very desirable and I highly recommend them. Other plans may have a higher premium, but the deductible is usually substantially lower. It all depends on your situation – find the plan that is right for you.

Don’t put off your purchase of health insurance. Having health insurance will protect you against hospital bills that threaten your financial livelihood. If I hadn’t been covered by health insurance, my yearly medical bills would have been closer to $25,000 rather than the $3,300 I paid as an out of pocket maximum.

I will be writing posts about health insurance every now and then because it can be such a large expense in life, and the costs can come up very unexpectedly. Trust me – I may be maxing out my health insurance two years in a row, almost entirely from unexpected expenses.

_________________________________

Full Disclosure: I do work for a major health insurer, but this post was in no way sponsored by a health insurance company (let alone my employer) and these opinions are my own. I truly believe everyone should have health insurance, especially considering the fact that more affordable insurance should be available through health insurance exchanges starting in 2014.

I am hoping out health insurance will cover a lot of our expenses when my wife has our baby. I know we are covered for most things, but there always seems to be unexpected out of pocket costs that you don’t find out about until you are asked to pay.

@MonsterPiggyBank Keep in mind that there can be billing errors – there are thousands upon thousands of billing errors each day. If you don’t catch it, you could be paying for something that SHOULD be covered by the insurance company.

There may be lot of problems in the billing counter.Sometimes,the machine wont work properly,and will give errors.

http://www.medicarealabama.com/

Luckily my work pays for my health insurance, it would be so expensive otherwise!

@SenseofCents Actually, after browsing the site it isn’t terribly expensive. The main difference I see is a slightly higher monthly premium, but not by much.

I agree that it is scary to go without health insurance. People get in accidents or get sick all the time without having any warning. I have never gone without thankfully.

@GregatClubThrifty Very true, and that’s what the purpose of health insurance is: to protect you against the unexpected bills. I think people should make it a top priority to get coverage if they do not.

I agree that not having health insurance is a scary proposition. Without it, a minor problem could turn into a big problem when you’re tens of thousands of dollars in the hole and have no way to pay for it.

@FrugalRules Definitely, and that’s something I hope young adults in particular avoid! Student debt is enough, no need for a $30,000 hospital bill when you could pay just $3,300 or $4,000.

I already shared this with you David, but I’m a big proponent of health insurance as well. Without it our family would likely be in dire financial straits, or worse – bankrupt.

In 2008 my normally healthy 28 year old wife started complaining of a muscle pull in her leg. After going to the doctor they were telling her that yes, it probably was just a muscle pull. They told her to go home and ice it. My mother-in-law insisted that they give her a scan, and they were surprised to see that her entire leg had clotted over. It was a godsend that they discovered it and they wouldn’t have if my mother-in-law hadn’t insisted.

Over the next few weeks my wife was in the hospital and had 4 surgeries to clear out the clots in her leg. It was touch and go for a while and we thought she may lose her leg. In the end we had some of the best specialists in the world working on her case and she recovered and didn’t lose her leg. She still has some circulation issues in that leg, but she’s alive!

Thankfully we had good health insurance and despite racking up over $250,000 in medical care over those 3 weeks, we ended up paying closer to $3000 or so. Thank God for health insurance! Having only one event like this means we’re already far ahead!

@moneymatters Definitely, and these sorts of expenses come up unexpectedly. As someone who used to report on catastrophic claims, they come up more than people would think. Babies are a big expense, because if anything goes wrong during delivery it can shoot into the hundreds of thousands very quickly.

I’m so glad your wife is okay. I can’t imagine going through that.

@DC @ Young Adult Money Ah, yes. Babies are another good one. Our son had shoulder dystocia when he was born, in other words his shoulders got stuck on the way out. They did get him out and he was fine, but it was scary for a little while and he had to spend a day or two in the neonatal intensive care unit. So that was another 15-20k covered by insurance. Oh, and of course I had my appendix out in an emergency surgery – another 20k! We’ve definitely gotten our money’s worth!

@moneymatters Doesn’t it pretty much max your out of pocket just to HAVE the baby these days? At least that’s what I’ve heard. Again, I can’t imagine what you went through with Carter. I can only imagine that my kids will be riddled with sinus and asthma issues, just based on how I’ve fared.

Ugh, this reminds me I’m without health insurance now. We canceled ours to get by on one pay and now I have to pick it up again. The problem is, the area I moved to has a higher premium for the same plan! For someone who has to get their own health insurance, it’s just so expensive! And that’s the lowest plan pretty much. I’m not happy with the way health insurance is done in this country, but… I can completely agree that without it we’re pretty much screwed if we have to ride in an ambulance, worse yet stay in hospital. Thanks for reminding me David.

@Veronica @ Pelican on Money Sorry to hear about your situation Veronica. Don’t forget that starting in 2014 there will be somewhat more affordable plans on public exchanges! For now I suppose your only option is to look at a private exchange like eHealthInsurance and see what offers you get. If there is anything I can do to help let me know.

Very thorough post DC. And sinus surgery? Ouch!!

I wonder if people avoid buying the insurance because they feel that they can’t afford yet another monthly expense, or they feel it will never happen to them, although there are plenty of good examples of what can happen both in your post in and in the comments.

Many bloggers have done posts about travel insurance and the same thing seems to happen. By that I mean that people say that since they are healthy they do not need it. I find that so strange.

I would be so uncomfortable living without insurance. Here the government covers stuff like doctor visitors and any hospital stays or surgeries, but as a freelancer I also bought a plan that covers us for extras like ambulance, holistic health, crutches and that kind of stuff.

@TacklingOurDebt Yes it’s a bit different in Canada ;) But I also find it strange that since people are healthy they think they don’t need it. It’s not covering you for your current health or lack of health, it’s covering you financially if something unexpected happens! I’m glad you got additional coverage and I hope you never need it.

My wife has co-workers who forgo health insurance because they don’t want to pay the $40 or $50 a month that the company charges for it. I’ll admit that for a span of two years I did not have health insurance, luckily nothing happened. It was not covered at my place of employment and I wasn’t married yet. However, once I was married one of the first things that my wife did was add me on to hers. I consider the amount of money her company pays towards our insurance as part of her income.

Another great thing is that my wife’s place of employment picks up the first $3,000 of our $5,000 deductible. So we don’t pay anything OOP unless we need something major.

@JustinatTheFrugalPath That’s good, but NOT having it through an employer should be no excuse not to have it! I’m glad nothing happened to you, but if something did happen you could have been forced into bankruptcy. I’m glad you are on a plan now!

@DC @ Young Adult Money @JustinatTheFrugalPath Yes, those years were not my finest.

Agreed! You take a risk of something bad happening regardless if you’re in good health or not. I’m bummed I have to pay for my own, but it’s something I know I can’t live without.

@Beachbudget You’re being wise by purchasing it in the individual market! A lot of people are in the mindset that they will either get it through an employer or not at all – this is bad logic that can lead to some really unfortunate financial circumstances.

If you have other people depending on you than not having life insurance is a huge risk you are putting on people.

@Jon H Yeah life insurance is great…I didn’t mention it in this post but still a good thing to get.

Perfectly healthy people can rack up huge health bills in one day. My $5000 24 hour natural birth turned into two emergency surgeries and a week in the hospital, about $30,000 if I hadn’t had insurance. I would also add to make sure providers in your area are providers for the plan you sign up for. Probably not a concern in a city, but certainly in a smaller area.

@Eyesonthedollar Wow I’m so sorry to hear about your difficult delivery. I’m so glad you have insurance, and you had it for all the right reasons.

Thanks for mentioning eHealthinsurance. Because I don’t work a traditional 9:00 to 5:00 job the price of health insurance can be pretty high, without a subsidy from an employer. I willcheck this out.

@tsx1561 I’m glad you are checking it out. Personally I think it’s a great safeguard against huge medical bills from something catastrophic happening. If you have any questions let me know, I have been working in health insurance for over 2 years now – opinions are my own, of course ;)

Jon H I agree! I’m 28 and single but hadn’t thought about it for my parents’ sake if I were to die. I had a $100k term policy for a year. But now I have Solid equity in my house and very few debts so I’ve dropped it. Will definitely pick back up when I’ve got a family depending on me.

DC @ Young Adult Money TacklingOurDebt Exactly — I HATE insurance, but health insurance is one of the few that I’m definitely willing to bite the bullet for.

I think in these days health

insurance is one of the important things which all must have in their life. As medical

cost increasing day by day all we have to have health insurance. I always keep

updated with my health insurance because no one can predict when we got ill. I

always claim my insurance whenever I go to hospitals, http://www.lookswoow.com/, and even in cosmetic clinic

too.