Feeling out of control with how much you are required to pay every month towards your federal student loans? Then you may want to consider other options.

For anyone with federal student loans, you have a few different choices when it comes to your repayment.

Income-driven repayment plans were created to help borrowers potentially lower their required minimum monthly student loan payment, making their required payment more affordable. Student loans are complicated, so think of this post as a an intro to income-driven repayment options.

Note – we don’t go into detail in this post, but there is brand new student loan repayment plan that was proposed by the Biden administration in January 2023. You can read all the details of this plan, which we are calling New REPAYE, in this post.

Types of Income-Driven Repayment Plans

When you start paying back your federal student loans, you are automatically enrolled into the standard ten-year repayment plan. This repayment plan assumes that it will take ten years to pay off your student loans, and will require you to pay a set minimum monthly payment. This payment doesn’t change from month-to-month – it remains constant throughout the ten years of your loan.

While the standard ten-year repayment works well for some people, it may not be an ideal fit for everyone. If your monthly student loan payments eat up too much of your take-home pay, you may want to consider an income-driven repayment plan.

The term income-driven repayment is a broad term that encompasses four different types of repayment plans. Each plan is a little different, and will be outlined in this post. Generally, with income-driven repayment plans, instead of paying standard monthly payments to your loan balance, the amount you will be required to pay is directly tied to your income (more specifically, your adjusted gross income as reported on your taxes). The idea behind this is to ensure payments are actually affordable for student loan borrowers.

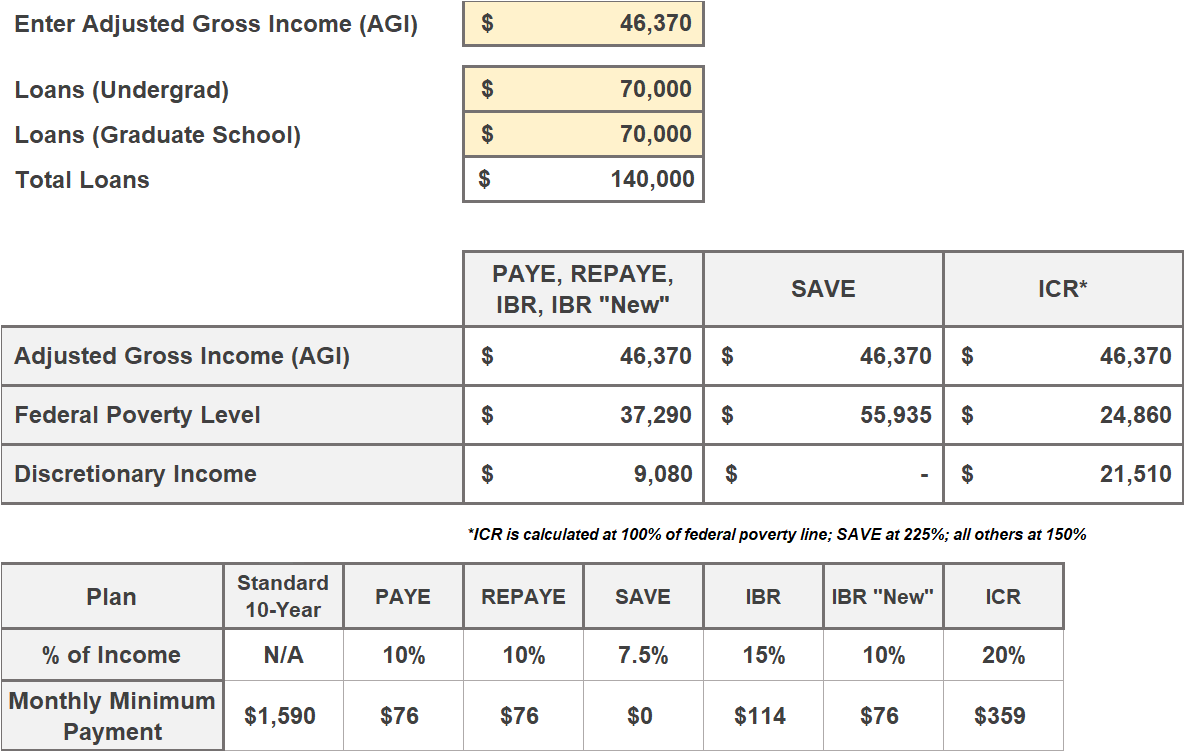

Below are the four income-driven repayment plans, starting with the most favorable to least favorable:

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Based Repayment (IBR)

- Income-Contingent Repayment (ICR)

Eligible Loans for Income-Driven Repayment Plans

Not all federal loans are eligible for income-driven repayment. Here is a summary of eligible loans for each plan:

PAYE: All Direct loans except Parent PLUS loans and consolidation loans that repaid Parent PLUS loans

REPAYE: All Direct loans except Parent PLUS loans and consolidation loans that repaid Parent PLUS loans

IBR: All Direct loans and FFEL loans except Parent PLUS loans and consolidation loans that repaid Parent PLUS loans

ICR: All Direct loans except Parent PLUS loans; Consolidation loans made after July 1, 20016 that repaid Parent PLUS loans are eligible

Note that private student loans and federal student loans that were refinanced through a private lender do not qualify for an income-driven repayment plan. If you have private student loans read this post for tips on how to best go about repaying them.

Here’s an overview of each repayment plan.

1) Pay As You Earn (PAYE)

Pay As You Earn, or PAYE, is the most favorable IDR plan. Monthly payments are capped at 10 percent of your monthly discretionary income, and there is an opportunity for loan forgiveness after 20 years of qualified payments.

You must have been a new borrower as of October 1, 2007 or had no prior outstanding loan balances and took out a new direct loan on or after October 1, 2011. If you are ineligible for this repayment plan, you REPAYE is a good alternative.

2) Revised Pay As You Earn (REPAYE)

The Revised Pay As You Earn, or REPAYE, repayment plan is the newest option for anyone seeking an income-driven repayment plan. It works similarly to the PAYE plan, except it doesn’t have the “new borrower” requirements that PAYE has. It does come with a “marriage penalty,” though; your spouse’s income is taken into consideration in the calculation of discretionary income. On the PAYE plan a spouse’s income is only considered if you file taxes jointly; you can file married filing separately to exclude their income from the calculation.

Loan forgiveness is possible after 20 years of qualified payments for undergrad debt, or 25 years if you are repaying any graduate debt.

3) Income-Based Repayment (IBR)

The Income-Based Repayment, or IBR, plan sets your monthly payments at 10% if you are a new borrower or 15% if you are not a new borrower. To be an eligible “new” direct loan borrower for IBR you must satisfy a couple of requirements: you have not taken out a federal direct loan prior to July 1, 2014 and have no outstanding balance on a FFEL Program loan when you receive a direct loan on or after July 1, 2014. If you are a new borrower you are eligible for loan forgiveness after 20 years of qualified payments, or 25 years if you are not a new borrower.

The biggest benefit of IBR is that FFEL loans are eligible, which isn’t the case on any of the other income-driven repayment plans. Granted you can create a direct loan by consolidating FFEL Program loans.

4) Income-Contingent Repayment (ICR)

The Income-Contingent Repayment, or ICR, plan, is the least favorable income-driven repayment plan. It caps your payments at 20% of your discretionary income and offers loan forgiveness after 25 years of qualified payments.

The biggest benefit of ICR is that it’s the only IDR plan that Parent PLUS Loans and consolidation loans that repaid Parent PLUS Loans are eligible for.

Is an Income-Driven Repayment Plan for You?

There are several benefits to income-driven plans. One of the most obvious benefits is that they allows for more affordable monthly student loan payments.

If you have a smaller income, a large amount of student loan debt, or both, you may be finding it difficult to pay your monthly student loan bill. While Income-Driven Repayment plans often cost more money over the long-run, it’s a better option than simply ignoring your student loans because you can’t afford the payments. Not making your student loan payments will eventually lead to default, which ultimately increases the amount of money that you owe. An income-driven repayment plan can help avoid default.

Depending on which plan you enroll in, you may be eligible for student loan forgiveness after 20 to 25 years if you make consistent, on-time payments. Just keep in mind, any remaining student loan balance that is forgiven will be considered to be taxable income and could result in a large bill come tax-time (something we commonly refer to as the “tax bomb”). With that being said, getting loans forgiven can be a big win. Student loan interest also doesn’t compound as long as you don’t have a capitalization event (i.e. switching income-driven repayment plans), so the actual debt you get forgiven will build up slower than, say, credit card debt, which has interest that compounds over time.

Finally, if you are working towards Public Service Loan Forgiveness (PSLF), an income-driven repayment plan is what you want to be in.

Understand your Student Loans using a Student Loan Spreadsheet

![]()

We have a free student loan spreadsheet that helps you organize all the details of your student loans in one place. This snapshot of your loans can help you determine what repayment plans you are eligible and what plans make sense.

You can download the spreadsheet in the box below, or read about all the features here.

Join our Online Community to Receive your FREE Student Loan Spreadsheet