Have you heard of the 52 Week Money Challenge?

Have you heard of the 52 Week Money Challenge?

It’s an easy way to save over $1,000 in one year. $1,378 to be exact.

The 52 Week Money Challenge is realistic for anyone because it doesn’t require the same amount of money to be saved each week. That’s because over the course of 52 weeks you save as little as $1 and, at most, $52.

Let’s take a more detailed look at how the 52 Week Money Challenge works, and some alternative ways of doing the challenge.

How the 52 Week Money Challenge Works

The 52 Week Money Challenge is simple. Over the course of 52 weeks, you make a deposit into your savings account once a week. The deposits range in value from $1 to $52.

One way people do this is deposit $1 the first week, $2 the second week, $3 the third week, and so on. At the end of 52 weeks the deposits total $1,378.

Another way to do this is vary the payments. Perhaps you deposit $52 the first week, $1 the second week, $51 the third week, and so on. This works well when there are busy times, like Christmas, where money is tighter, or if you have an unexpected expense that sets you back.

Being able to adjust your weekly contribution as needed is an added layer of flexibility to the challenge, but not everyone takes that approach. It can be easier to just stick with increasing your contribution each week by $1. Who knows? Maybe you will even continue past the 52 weeks.

Another variation is to multiply the amount you save. Depositing $1 through $52 is great because you will save $1,378 in one year, but why not up the ante? If you deposit $5 through $260 in increments of $5, you would have nearly $7,000 saved. This is a great way to make a game out of building an emergency fund.

I recommend having a separate savings fund at a different bank than your home bank or credit union to create a separation between the money you have for spending and the money you are saving for a rainy day. My choice is a high-yield savings account at CIT Bank. Many banks pay almost nothing in interest for their savings account. You deserve to get a high interest rate on your savings account, and CIT Bank is a great option.

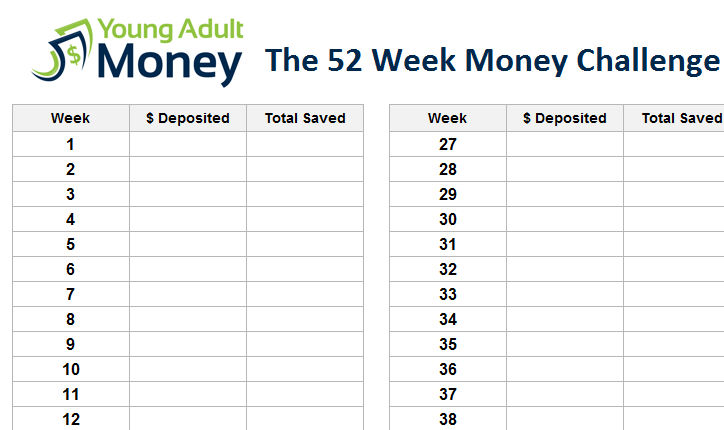

Download the 52 Week Money Challenge Spreadsheet and Printable

If the 52 Week Money Challenge sounds like something that you want to try, we have a free 52 Week Money Challenge Spreadsheet and Printable for you.

If you want the spreadsheet or printable, you can get a free copy below.

Don’t miss out on our free budget spreadsheet or these travel rewards credit cards that can help you achieve your travel goals faster.

Get the spreadsheet here:

Join our Online Community to Receive your FREE 52 Week Money Challenge Spreadsheet

Get the printable here:

Join our Online Community to Receive your FREE 52 Week Money Challenge Printable

Very cool tool to offer DC. I love things like this money challenge because’s it not all that difficult to start and if you automate it, it can be a nice little way to save some cash. I’ve never done a savings challenge, per se, but we so automate savings in a number of areas.

Automation is always good! I love hearing success stories from people who tried the challenge. I hope offering the downloads will encourage more to give it a try.

I got both of them. Thanks DC. =)

Good to hear! I hope you like them!

I love this challenge – I’ve done it before! I started on Jan 1st, and worked backwards, starting with $52. If you get some money for Christmas, it’s a good way to start!

That’s a great way to do it! I also think people are a bit more motivated in January and February so it makes sense to start with the higher amounts.

My younger sister did a version of this. She attempted to earn extra income each week, but she really leveled up. She did 5X (so week 1, $5, Week 2, $10, etc.).

She started out selling stuff and babysitting, but she got pretty creative in the end when she had to earn $260 in a week

That’s awesome that she did a multiple of the challenge! For some people saving $1,400 in a year is a big help, but if you did this challenge at a multiple of 5 you’d be saving a lot more, which is always good.

I love savings challenges because it’s another person’s perspective on saving approaches. Your saving challenge is a novel one that I haven’t seen before, great ideas! Saving should be in someone’s blood to better themselves financially.

Saving challenges can definitely serve as motivation for those who it isn’t “in their blood” to better themselves financially. Starting small has worked for a lot of people when it comes to finances, and this challenge allows you to build on your success week-after-week.

Nice DC! Cool concept & this could almost be an app, although there’s competition or similar types of software out there, this could be an awesome idea

I’m more of a create the habit & track each expense, which has worked for me although your idea is excellent..

I’d go boring & invest the extra $$ :) ha

Great point Jef, this could definitely be an app! If someone does develop one I’d definitely consider pointing people in their direction, but for now I think the spreadsheet and printable can get the job done for most people : )

Such a good challenge! I don’t know why I always associate these challenges with Christmas and the holidays. I need to get in the mindset that this challenge would be good anytime of the year or for planning a vacation or major purchase or something :)